This weekly report compiles and analyzes key economic and policy developments, offering insights into their potential impact on global markets.

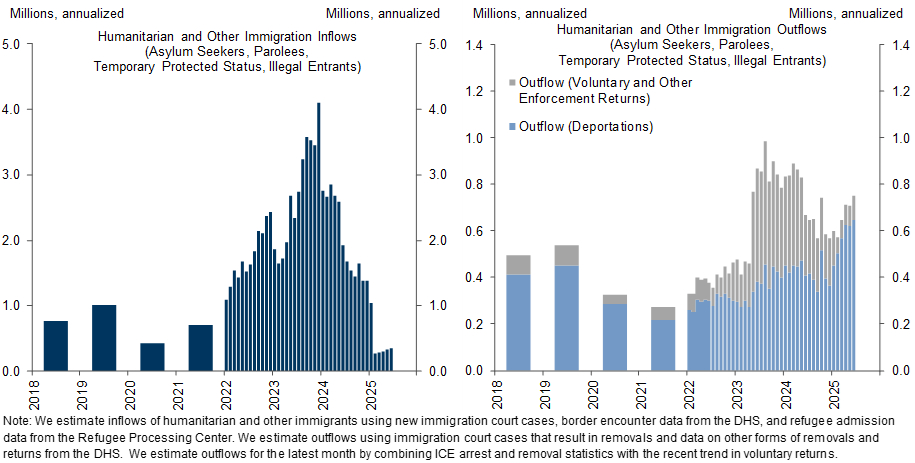

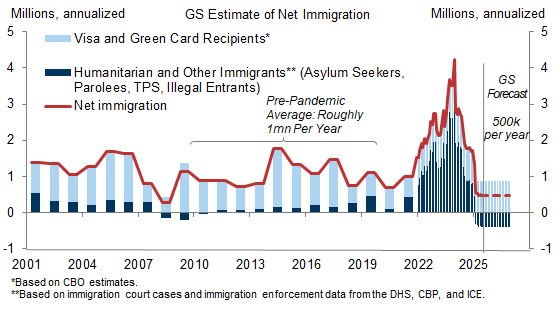

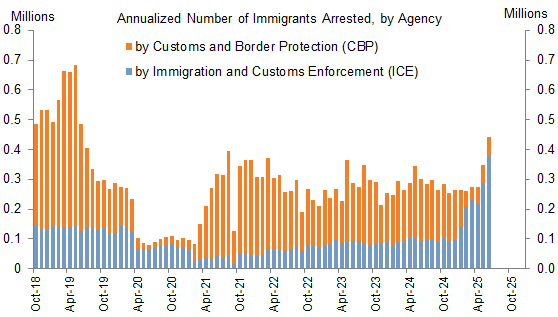

Goldman Sachs' Elsie Peng in her June Immigration Update report notes that US net immigration speed has slightly decreased from 600k to 500k per year, expected to stabilize at this level, and remains below the pre-pandemic trend of 1M per year. While humanitarian immigration inflow remains stable, total outflow (including voluntary departures and deportations) has increased, and enforcement focus has shifted from the border to internal operations, leading to a significant rise in Immigration and Customs Enforcement (ICE) arrests; however, Goldman Sachs expects legal and capacity constraints will limit further substantial growth in deportations. Simultaneously, recent immigrants' employment status remains healthy, and even with declining survey response rates, the overall impact on employment is limited, with immigration slowdown projected to reduce the employment breakeven rate to approximately 70k per month by the end of 2025.

US net immigration speed decreased from 600k in April to 500k in June, aligning with Goldman Sachs' forecast of stabilization at 500k annually. This is moderately below the pre-pandemic trend of 1M annually. Humanitarian and other immigrant inflows remain stable at an annualized 300k, but total outflows increased to an annualized 700k in June, driven by voluntary departures and deportations.

Click image to enlarge

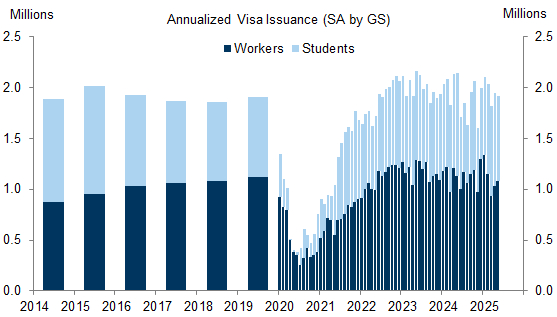

Visa issuance data indicates legal immigration inflows are consistent with historical trends. A brief two weeks suspension of student visa interviews in May is not expected to significantly impact legal immigration.

Click image to enlarge

Analysis:

Goldman Sachs estimates net immigration at 500k annually, which includes 900k net immigrants from visas/green cards and -400k net outflow from humanitarian/other categories (with 700k outflow offsetting 300k asylum seekers/illegal entries). Their forecast of 500k is moderately lower than the pre-pandemic 1M, but higher than the -200k forecast by Brookings/AEI, primarily due to Goldman Sachs expecting limited room for increased voluntary departures.

Click image to enlarge

Scroll horizontally on mobile to view full table.

| Source | Net Immigration Forecast (annualized) | Humanitarian & Other Net Migrants |

|---|---|---|

| Goldman Sachs (H2 2025) | 500k | -400k |

| Brookings / AEI | -200k | -900k |

| Pre-pandemic (2014-2019 avg) | 1.1M | N/A |

Since early this year, immigration enforcement has shifted from border (Customs and Border Protection - CBP) to internal (Immigration and Customs Enforcement - ICE). CBP arrests have sharply declined, while ICE arrests significantly increased from an annualized 100k in January to 400k in June, far exceeding historical trends. Though Goldman Sachs expects legal and capacity constraints to limit further increases in deportations, continuous rise in ICE arrests and recent additional funding suggest upside risk to deportation forecasts and downside risk to immigration forecasts.

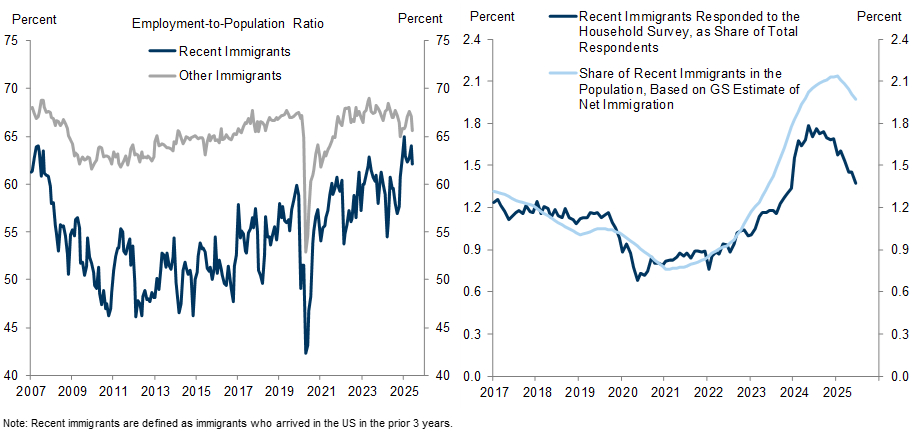

Click image to enlarge

Despite tightening immigration policies, the labor market performance of immigrants already in the US remains relatively healthy. Analysis of detailed household survey microdata for June indicates that the employment-to-population ratio for recent immigrants has remained stable at approximately 62%, slightly below the 64% at the beginning of the year. A concerning sign is the continued decline in survey response rates among recent immigrants. The proportion of recent immigrants among survey respondents has fallen by 0.3 percentage points (pp) since the beginning of the year, while their proportion in the population has only decreased by 0.15 percentage points (pp). This raises concerns that tightening immigration policies might lead many unauthorized immigrants, fearing repercussions, to stop responding to household surveys. However, even under an extreme assumption where all newly non-responding individuals have exited the labor market, this decline suggests only a modest impact of 6% (approximately -200k people) on total recent immigrant employment.

The sharp slowdown in net immigration has reduced the breakeven rate (employment growth needed to maintain stable unemployment) from 200k per month in early 2024 to approximately 90k per month in June. Goldman Sachs expects the breakeven rate to continue to decline, reaching approximately 70k per month by the end of 2025.

Click image to enlarge

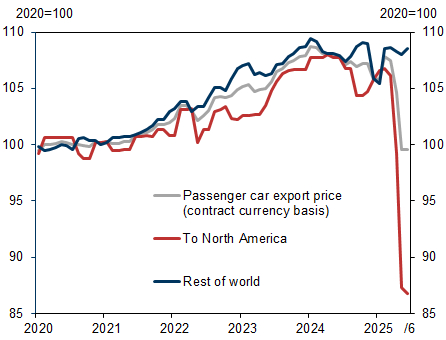

Tomohiro Ota from Goldman Sachs' report centers on who primarily bears the burden of US tariffs. Analyzing Japan's export data to the United States (especially passenger vehicles), the report indicates that while traditional views suggest the tariff burden ultimately falls on importing country consumers, initial evidence shows Japanese exporters in certain industries (especially passenger vehicles and steel/aluminum), to maintain market share, opted to absorb most of the tariffs by lowering export prices, thereby mitigating rises in US sales prices. However, this absorption is currently limited to specific industries and may be influenced by temporary factors, with prices potentially recovering in the future. If this trend of exporters bearing tariffs continues, it will negatively impact Japanese corporate profits and Nominal GDP.

The allocation of tariff burden is a key concern for market participants and economists, impacting US inflation trends, and Japan's future export volumes and corporate profitability. Donald Trump signed an executive order on July 7, delaying reciprocal tariffs to August 1, followed by a letter to Japan indicating intent to raise tariffs to 25%. Uncertainty surrounding Japan-US negotiations remains high; progress is unlikely before the July 20 Senate election. If the ruling party fails to maintain a simple majority and the Ishiba Cabinet collectively resigns, negotiations might stall due to the absence of key participants. Goldman Sachs' US economic research team assumes that if no agreement is reached, the US will uniformly raise base reciprocal tariff rates for all countries from 10% to 15% (or to 25% for Japan). In this scenario, how Japanese exporters pass on tariffs to US sales prices will be crucial for forecasting US domestic prices, exporters' future profits, and Japan's export volumes.

Japanese passenger car export prices to North America cumulatively decreased by approximately 20% during April-June 2025. This indicates that, at least for now, Japanese automakers chose to absorb most of the additional 25 percentage points of tariffs themselves, thereby mitigating rises in US sales prices. This phenomenon contradicts the recent view that US consumers and businesses ultimately bear the full US tariff burden through higher domestic prices. Traditional academic views suggest that when a major country imposes tariffs, export companies from other countries are likely to lower their export prices to maintain market share. However, many studies after the first Donald Trump administration's tariffs showed no such decline in export prices to the US, leading to the prevalent view that tariffs, even for major countries, directly translate into higher domestic prices rather than being absorbed by exporters. If the trend of declining passenger car export prices spreads to other industries (and other exporting countries), it will contradict the current popular view, which is crucial for assessing the impact of tariffs on US prices, exporter profits, and Japan's export volumes. The report analyzed trade statistics released on May 7, 2025, to study the impact of tariffs on export prices across various industries. Possible explanations for the decline in passenger car export prices include: intense market competition (especially in consumer goods like passenger cars, making price increases difficult; most Japanese automakers export mass-market models with high price elasticity), price revision lag (passenger car prices are typically revised with model updates, less frequently, possibly leading to a lag in US price increases compared to other products, thus current price declines might be temporary), and observing diplomatic negotiations (Japanese automakers may be awaiting the outcome of Japan-US diplomatic negotiations, avoiding price revisions until uncertainty is resolved).

Click image to enlarge

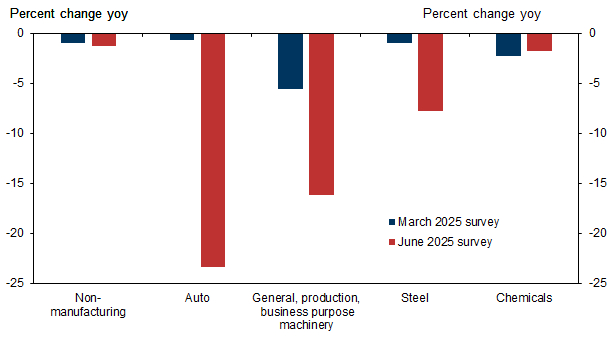

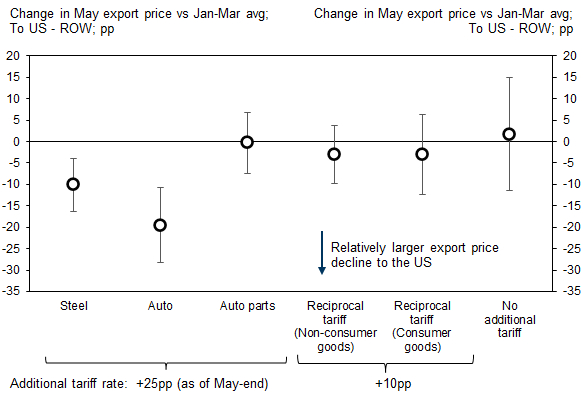

Changes in export prices to the US (May vs. January-March average): US - other regions. Only passenger vehicles and steel/aluminum export prices show statistically significant declines.

Tariffs have significantly different impacts on export prices across industries:

The report highlights that the current trend of exporters lowering prices (absorbing the tariff burden) to maintain US sales prices is limited to specific industries. The report concludes from May 2025 data that it cannot currently be asserted that the view "US tariffs are mainly borne by domestic consumers and businesses" is disproven, but notes that passenger car exports account for 30% of Japan's total exports to the US, which is not insignificant. The current results are preliminary, and future situations may change. For instance, the decline in Japanese automaker export prices might be temporary, with prices expected to gradually recover. Although some studies suggest that after the first Donald Trump administration's additional tariffs on steel, countries' steel export prices decreased by about half of the tariff increase, it remains unclear whether the full additional tariff burden can be passed on to US sales prices in the long term; continuous monitoring of price trends is needed for a final conclusion.

Click image to enlarge

If passenger car export prices remain low, it will lead to a decline in Japanese corporate profits, potentially causing Japan's Nominal GDP to fall below current expectations. The Bank of Japan's June 2025 Tankan Survey on June 12 showed a significant deterioration in the ordinary profit outlook for the automotive manufacturing industry, consistent with the substantial decline in export prices. The impact on Real GDP, on the other hand, is unclear: limited increases in US sales prices may curb the decline in passenger car export volumes. Export volumes also depend on pricing strategies of other countries. A decline in Japanese corporate profits might lead to a decrease in domestic demand (e.g., private consumption and capital expenditure).

Click image to enlarge