2025 W30 Global DM Selected Top-down Reports 2025 W30 全球DM精选自上而下报告

Retail-Driven Speculative Frenzy Reignites S&P 500 Index Inclusion Effect 散户驱动的投机热潮重燃标普500指数纳入效应

Key Logic: Market Dynamics & Outlook 核心逻辑:市场动态与展望

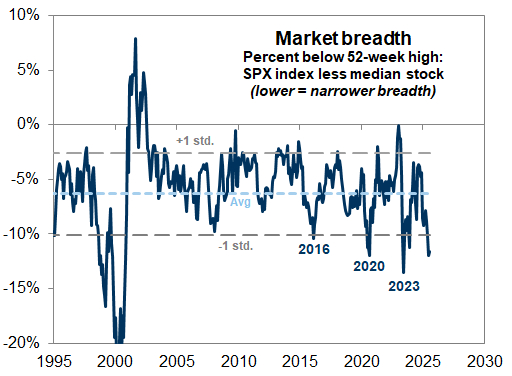

Recent retail-driven speculative frenzy in the US equity market, characterized by surging trading volumes in unprofitable, low-priced, and high-valuation stocks, active call options, high social media sentiment, and short squeezes, has significantly reignited the S&P 500 index inclusion effect. This is particularly evident in non-S&P 400 mid-cap migrations and retail-favored stocks related to hot themes like AI. Although the excess returns from this inclusion effect primarily occur before the announcement and are not persistent, it indicates potential short-term upside risk for the stock market. However, in the long term (24 months), it may increase market downside risk. Meanwhile, the narrow market breadth suggests that internal sector rotation may continue. 近期美国股票市场由散户驱动的投机热潮,通过无盈利、低价股和高估值股票交易量激增、看涨期权活跃、社交媒体情绪高涨以及空头挤压等多种形式,显著重燃了标普500指数纳入效应,尤其体现在非标普400中型股迁移、受散户青睐且与人工智能等热门主题相关的股票上,尽管这种纳入效应带来的超额收益主要发生在公告前且不具持久性,但短期内预示着股市潜在上行风险,而长期(24个月)则可能增加市场下行风险,同时狭窄的市场广度也预示着市场内部板块轮动可能持续。

Recent US Equity Market Speculative Trading Activity Has Significantly Rebounded 近期美国股票市场投机交易活动显著回升

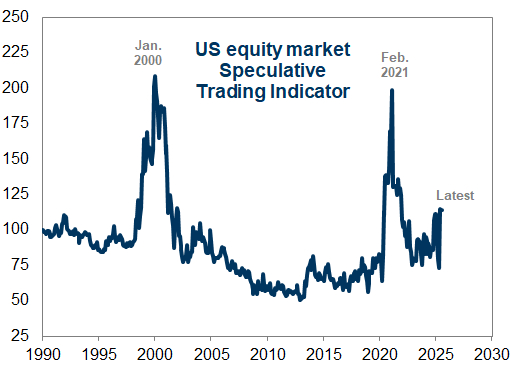

Goldman Sachs Speculative Trading Indicator Soars 高盛投机交易指标飙升

Goldman Sachs' Speculative Trading Indicator has sharply risen in recent months, reaching levels unprecedented outside of the 1998-2001 and 2020-2021 periods, though still below those historical peaks. This indicator reflects the growth in trading volume of unprofitable stocks, penny stocks, and stocks with an EV/Sales multiple above 10x. 高盛的投机交易指标在过去几个月急剧上升,当前水平已达到除1998-2001年和2020-2021年期间以外的最高点,但仍低于上述历史高位。该指标反映了无盈利股票、低价股和EV/销售额倍数高于10x的股票交易量的增长。

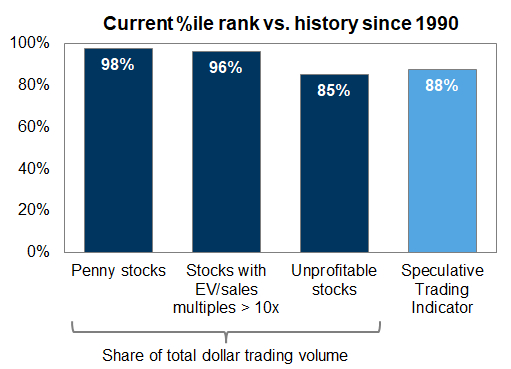

Methodology Snapshot 衡量方法速览

It's the first principal component of monthly changes in the US public equity dollar trading volume attributable to three categories: unprofitable stocks, penny stocks, and stocks with an EV/Sales multiple greater than 10x. In the past 1 month, trading activity for all three categories was in the top 20% since 1990. 该指标是美国公共股票美元交易额中,归属于以下三类股票的月度变化比例的第一主成分:无盈利股票、低价股和EV/销售额倍数大于10x的股票。在过去1个月,这三类股票的交易活动占比均处于自1990年以来的前20%。

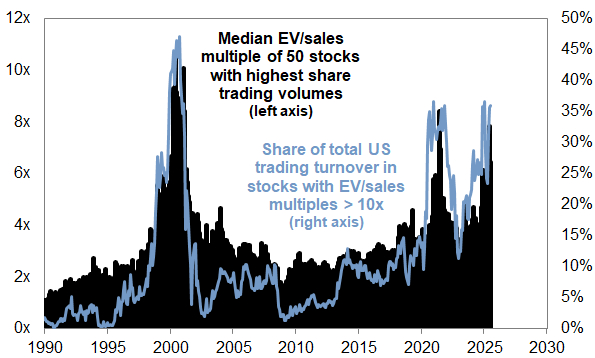

Trading Volume Concentrates on High-Multiple Stocks 交易量日益集中于高倍数股票

Recently, US equity trading volume has increasingly concentrated on high-multiple stocks. The median EV/Sales multiple of high-volume stocks has surged in recent months, currently reaching 8x. This level is the highest in recent decades, excluding only the years 2000 and 2021. 近期美国股票交易量日益集中于高倍数股票。高交易量股票的中位数EV/销售额倍数在过去几个月大幅飙升,目前达到8x,这是除2000年和2021年以外近几十年的最高水平。

S&P 500 Index Inclusion Effect: Recent Recovery and Its Drivers 标普500指数纳入效应的近期复苏及其驱动因素

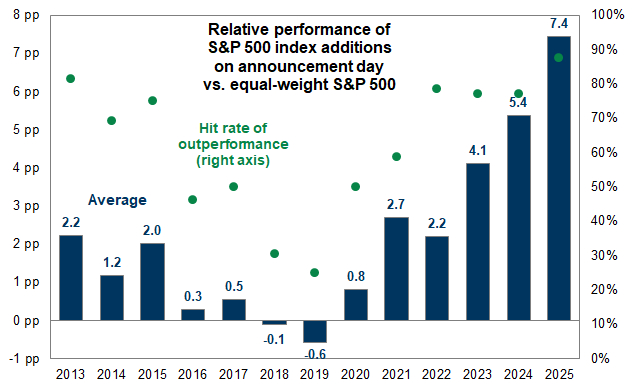

Significant Recovery Since 2021 自2021年以来显著复苏

Since 2021, the S&P 500 index inclusion effect has significantly recovered, with newly included individual stocks on average outperforming the equally-weighted S&P 500 index by 4 pp on the announcement date. During this period, 48 (74%) of the 65 stocks (excluding spin-offs) included in the S&P 500 index achieved excess returns on the announcement date. 自2021年以来,标普500指数纳入效应显著复苏,被纳入的个股在公告日平均跑赢等权重标普500指数4 pp。在此期间,65只被纳入标普500指数的股票(不包括分拆)中,有48只(74%)在公告日实现了超额收益。

In contrast, between 2016 and 2019, the inclusion effect almost disappeared, with less than 40% of included stocks achieving excess returns on the announcement date, and an average relative return of only 0.1 pp. The recent recovery challenges previous academic theories attributing the decline to increased investor awareness. 在2016年至2019年期间,指数纳入效应几乎消失,在此期间,被纳入指数的股票中仅有不到40%在公告日实现超额收益,平均相对收益仅为0.1 pp。近期效应的复苏对这一理论提出了挑战。

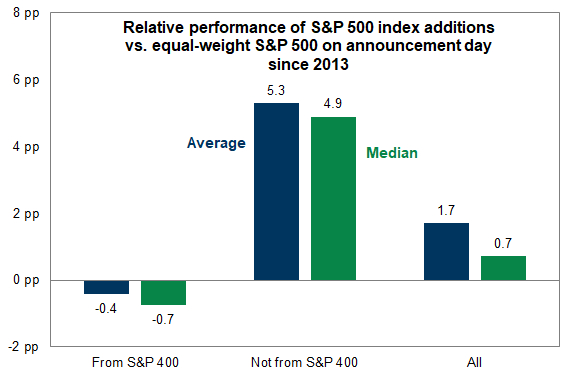

Impact of Stock Origin on Inclusion Effect Performance 股票是否从S&P 400中型股指数迁移对纳入效应的表现影响显著

Since 2013, when stocks were not sourced from the S&P 400, the average relative return on the announcement date was 5.3 pp, while stocks migrating from the S&P 400 saw -0.4 pp. The underperformance of S&P 400 migrating stocks aligns with the rise of mid-cap-focused passive equity funds. 自2013年以来,当股票并非源自S&P 400时,公告日平均相对收益为5.3 pp,而从S&P 400迁移的股票则为-0.4 pp。从S&P 400迁移的股票表现不佳,与以中型股为重点的被动式股票投资基金的兴起不谋而合。

In recent years, the proportion of stocks migrating from the S&P 400 has decreased, falling below 50% after steadily growing to about 70% between 2016 and 2021 (it was about 50% in the 1990s). 近年从S&P 400迁移的股票比例有所下降,此前该比例在1990年代约为50%,并在2016年至2021年间稳步增长至约70%,但近几年已降至50%以下。

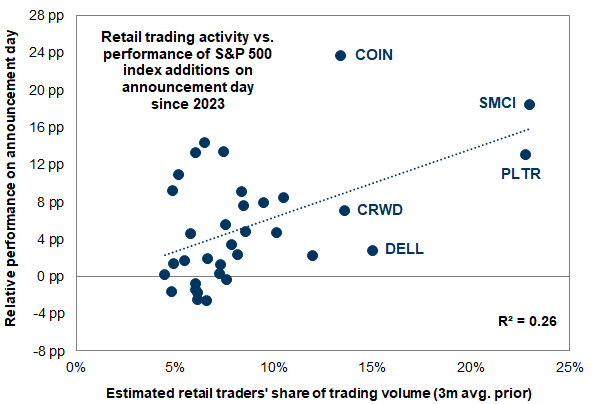

Retail Preference, Hot Themes (like AI), and Surging Call Option Volume Drive Inclusion Effect and Speculative Activity 散户偏好、热门主题(如人工智能)与看涨期权交易量激增共同推动纳入效应和投机活动

Many recently best-performing included stocks are favored by retail investors and related to hot themes like AI. For example, stocks like Coinbase Global, Super Micro Computer, and Palantir Technologies are extremely popular in retail trading and significantly outperformed on their announcement dates. The inclusion effect is amplified by hot themes, such as AI-related Super Micro Computer, Palantir Technologies, and Datadog, which have been among the best-performing included stocks. 许多近期表现最佳的纳入股受到散户青睐,并与人工智能等热门主题相关。Coinbase Global、Super Micro Computer和Palantir Technologies等股票在散户交易中极受欢迎,并在公告日大幅跑赢。纳入效应与人工智能投资周期等热门主题相叠加,例如Super Micro Computer、Palantir Technologies和Datadog等表现最佳的纳入股均受益于人工智能相关主题。

Call option trading volume has surged in tandem with "speculative" cash trading volume. In the past 1 month, call options accounted for 61% of total option trading volume. This percentage is on par with December 2024 and is the highest in nearly a decade, excluding the period from summer 2020 to early 2022, while the 20-year average stands at 55%. 看涨期权交易量与“投机性”现金交易量同步激增。过去1个月,看涨期权占期权总交易量的61%。这一比例与2024年12月持平,是自2020年夏季至2022年年初期间以外的近十年最高值,而20年平均水平为55%。

S&P 500 Index Inclusion Effect: Timeliness and Academic Debate 标普500指数纳入效应的时效性与学术争议

Academic Debate on Persistence of Inclusion Effect 指数纳入效应的持久性在学术界存在广泛争议

The persistence of the S&P 500 index inclusion effect is widely debated academically. Early research often attributed the effect to excess demand from indexation, signaling increased future cash flows, and reduced required returns due to improved liquidity and investor awareness. However, recent academic studies find that index inclusion has no lasting impact on company value. 标普500指数纳入效应的持久性在学术界存在广泛争议。早期研究通常将纳入效应归因于指数化带来的超额需求、信号传递导致的未来现金流增加,以及流动性改善和投资者认知度提高带来的所需回报率降低。然而,近期学术研究发现,指数纳入对公司价值并没有持久影响。

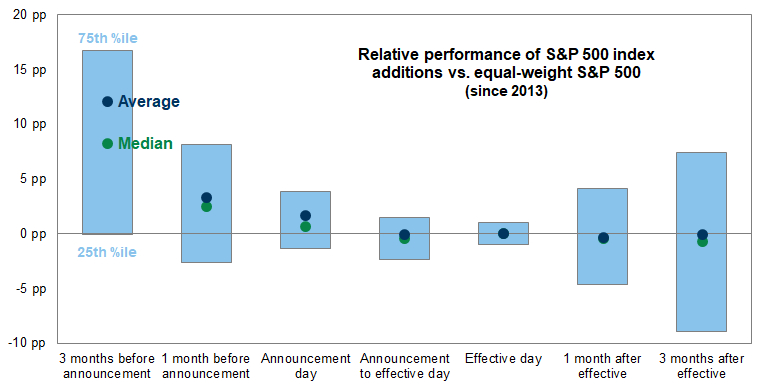

Key Finding on Excess Returns Timing 超额收益时机关键发现

The most significant excess returns for index included stocks typically occur before the announcement. Since 2013, the average excess return 3 months prior to the announcement was 12 pp, likely reflecting market capitalization growth creating conditions for inclusion. Returns on the announcement date are stronger than on the effective date, with an average interval of about 5 trading days between announcement and effective date. However, there are no signs of persistent excess returns in the months following inclusion (average 0 pp 3 months after inclusion). 指数纳入股票最显著的超额收益通常发生在公告之前。自2013年以来,公告前3个月的平均超额收益为12 pp,这可能反映了市值增长为指数纳入创造了条件。公告日的回报强于生效日,公告与生效日之间的平均间隔约为5个交易日。然而,在指数纳入后的几个月内,没有持续超额收益的迹象(纳入后3个月平均0 pp)。

No Structural Change in Trading Volume Post-Inclusion 自2013年以来,指数公告和纳入后交易量没有结构性变化的迹象

Since 2013, there have been no signs of structural changes in index announcement and post-inclusion trading volume. Stock trading volume (defined as volume as a percentage of shares outstanding) significantly increases around the announcement and effective dates, consistent with positive returns on the announcement date and passive buying to match index composition. However, on average, the trading volume of index-included stocks is broadly similar 6 months before and after inclusion. 自2013年以来,指数公告和纳入后交易量没有结构性变化的迹象。股票交易量(定义为交易量占流通股百分比)在公告日和生效日附近显著提升,这与公告日积极回报和被动买入以匹配指数构成一致。然而,平均而言,指数纳入股票的交易量在纳入前后6个月大致相似。

Impact of Speculative Activity on Market Returns & Internal Market Structure 投机活动对市场回报的影响及市场内部结构

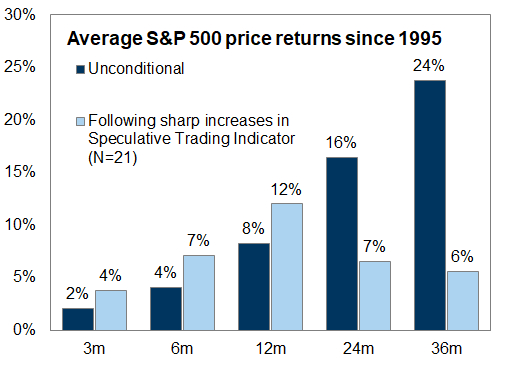

Short-term Positive, Long-term Risk 短期积极,长期风险

Historically, a sharp increase in speculative trading activity often signals above-average short-term stock returns (3 months, 6 months, 12 months). However, these short-term returns are usually accompanied by slightly higher short-term volatility and often lead to market pullbacks in the long run. 历史数据显示,投机交易活动急剧增加通常预示着短期(3个月、6个月、12个月)股票回报高于平均水平。但这些短期回报通常伴随着略高的短期波动性,并最终常常导致市场回调。

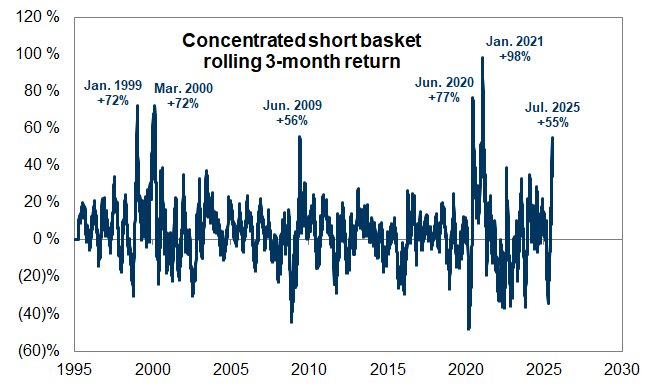

Short Squeeze Accompanies Speculative Surge 近期投机交易活动的激增也伴随着有记录以来最剧烈的空头挤压之一

The recent surge in speculative trading activity has also been accompanied by one of the most severe short squeezes on record. Since early April, the GS Most Short basket (GSCBMSAL) has rallied over 60%, outperforming the equally-weighted S&P 500 by approximately 40 percentage points. In the past 30 years, heavily shorted stocks have seen more intense rallies only in 1999-2000 and 2020-2021, which were the only periods when recent speculative trading activity surpassed current levels. 近期投机交易活动的激增也伴随着有记录以来最剧烈的空头挤压之一。自4月初以来,GS Most Short篮子(GSCBMSAL)已上涨超过60%,跑赢等权重标普500约40个百分点。在过去30年中,集中做空股票仅在1999-2000年和2020-2021年有过更剧烈的上涨,这两个时期也是近期投机交易活动超过当前水平的唯一时期。

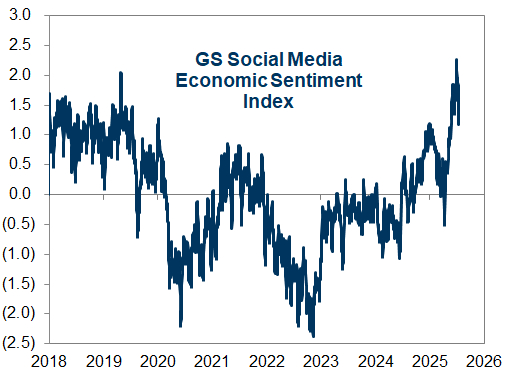

Social Media Sentiment Soars, Retail Favorites Rebound 社交媒体情绪高涨,散户偏好股票反弹

Similar to 2021, the recent short squeeze is accompanied by improved social media sentiment and a rebound in retail-favored stocks. Goldman Sachs economists' Social Media Economic Sentiment Index surged from negative values in April to its highest level since 2018 early this month. 如同2021年,近期的空头挤压伴随着社交媒体情绪的改善和散户偏好股票的反弹。高盛经济学家的社交媒体经济情绪指数从4月的负值飙升至本月初的2018年以来最高水平。

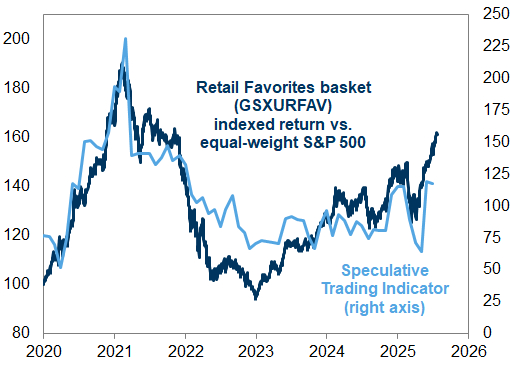

The GS Retail Favorites basket (GSXURFAV) has risen 51% since early April, outperforming the equally-weighted S&P 500 by 23%, aligning with the upward trend of the Speculative Trading Indicator. GS Retail Favorites篮子(GSXURFAV)自4月初以来上涨51%,跑赢等权重标普500 23%,与投机交易指标的上涨趋势一致。

Market Breadth Extremely Narrow, High Short Interest 市场广度极度狭窄,空头兴趣仍接近高位

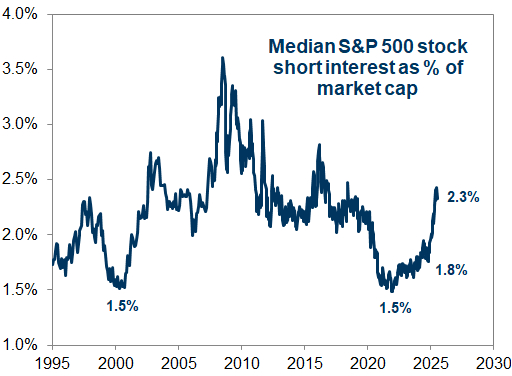

Despite the S&P 500 being at historical highs, positioning data indicates that US equity investors maintain a neutral average holding. Median S&P 500 stock short interest remains near its highest level since 2019, having sharply risen in recent months (as of July 15, 2025). 尽管标普500处于历史高点,但仓位数据显示,美国股票投资者平均持仓仍保持中性。中位数标普500股票的空头兴趣仍接近2019年以来的最高水平,近几个月空头兴趣急剧上升(截至2025年7月15日)。

Market breadth is extremely narrow, a condition that usually signals risk for intra-market momentum. Since early July, GS's Long/Short Momentum factor basket (GSP1MOMO) has fallen 10%, representing a drawdown in the 2% percentile relative to the past decade. 市场广度极度狭窄,这一状况通常预示着市场内部动量面临风险。自7月初以来,高盛的Long/Short Momentum因子篮子(GSP1MOMO)已下跌10%,相对于过去十年处于2%分位数的回撤。

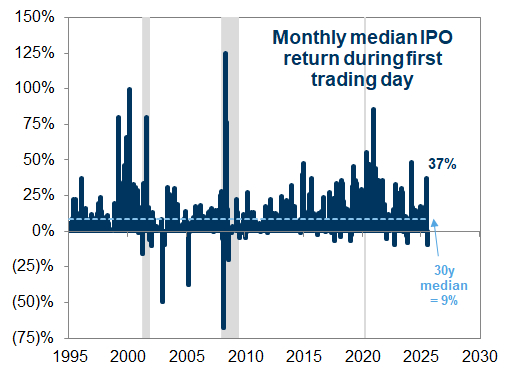

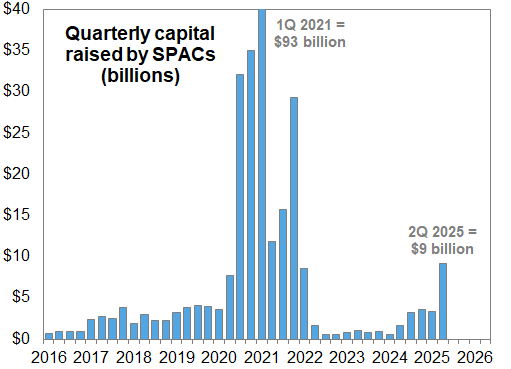

Increased Investor Risk Appetite Drives ECM Activity 投资者风险偏好提升也促进了近期股权资本市场(ECM)活动的活跃

Increased investor risk appetite has also contributed to the recent活跃 in equity capital market (ECM) activity. The median US IPO first-day return in June rose 37%, making it the best month since early 2024 and ranking in the top 10% of returns over the past 30 years. 投资者风险偏好提升也促进了近期股权资本市场(ECM)活动的活跃。6月份中位数US IPO首日回报上涨37%,是自2024年初以来最好的月份,也是过去30年中属于前10%的回报。

SPAC activity has also increased recently, with SPAC issuance in Q2 2025 reaching $9 billion, the highest since Q1 2022. This quarter saw 41 issuances, with total fundraising of $12 billion in H1 2025. SPAC活动近期也有所增加,2025年第二季度的SPAC发行量达到$9 billion,为2022年第一季度以来最高。本季度共有41宗发行,2025年上半年共募资$12 billion。

S&P 500 Index Inclusion Criteria and Potential Candidates 标普500指数纳入标准与潜在候选股

S&P Index Eligibility Standards & Discretion S&P指数资格标准与主观控制权

Standard & Poor's (S&P) publishes index eligibility standards, but the index committee retains a degree of subjective control. S&P notes that current S&P 1500 constituent stocks (S&P 500, S&P 400, S&P 600) can migrate between indices if they meet market capitalization criteria, without needing to satisfy financial viability or liquidity requirements. S&P also emphasizes that index component rotation should be avoided where possible, and eligibility criteria apply to new additions, not to continued retention. Standard & Poor's(S&P)发布了指数资格标准,但指数委员会享有一定的主观控制权。S&P指出,当前的S&P 1500成分股(S&P 500、S&P 400、S&P 600)可以在指数之间迁移,如果它们满足市值标准,则无需满足财务可行性或流动性要求。S&P还强调,应尽可能避免指数成分股的轮换,且资格标准是针对新增至指数,而非持续保留资格。

Key Inclusion Criteria: 关键纳入标准:

- Registration:注册地:Ordinary shares of US companies only. S&P may review registration on a case-by-case basis.仅限美国公司的普通股。S&P最终可能逐案审查注册地认定。

- Exchange:交易所:Must be listed on a US exchange, not OTC.必须在美国交易所上市,而非场外交易(OTC)。

- Structure & Stock Type:组织结构和股票类型:Corporations (including equity and mortgage REITs) and common stock.公司(包括股权和抵押REIT)及普通股。

- Market Cap:市值:Currently total market capitalization of $22.7bn or more. Float market cap must be at least 50% of the market cap threshold.目前要求总市值达到或超过$22.7bn。流通市值必须至少达到市值门槛的50%。

- Investable Weight Factor:可投资权重因子:Float factor must be at least 10%.要求浮动因子至少为10%。

- Liquidity:流动性:Monthly trading volume of at least 250,000 shares over the preceding 6 months. Float-adjusted liquidity ratio (annual USD trading value divided by float-adjusted market cap) should be greater than 0.75.在评估前6个月内,股票每月交易量应至少为250,000股。浮动调整后的流动性比率(年交易美元价值除以浮动调整后市值)应大于0.75。

- Financial Viability:财务可行性:Sum of GAAP net income for the most recent 4 consecutive quarters must be positive, and net income for the most recent quarter must also be positive. For equity REITs, based on GAAP earnings and/or reported FFO.最近连续4个季度的GAAP净利润总和应为正,且最近一个季度的净利润也应为正。对于股权REIT,财务可行性基于GAAP收益和/或报告的营运资金(FFO)。

- IPO:IPO:Should have traded on an eligible exchange for at least 12 months before considering for inclusion.在考虑纳入前,应在符合条件的交易所交易至少12个月。

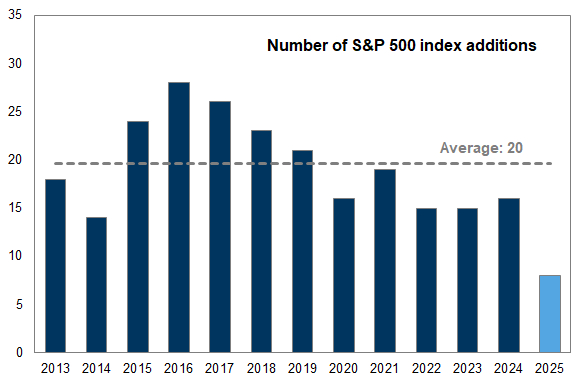

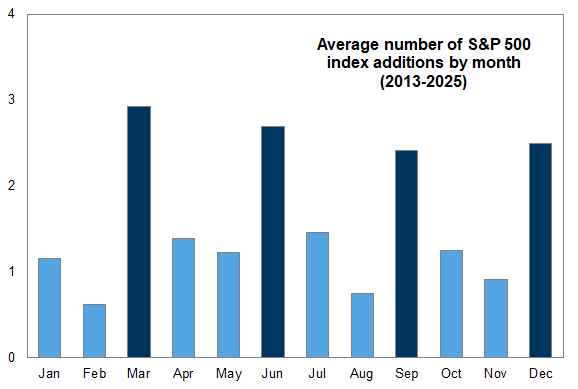

Seasonality of S&P 500 Index Inclusions S&P 500指数纳入的季节性

Inclusion events often follow a seasonal pattern. Click to enlarge. 纳入事件常呈现季节性。点击放大。

Most index announcements typically occur during quarterly rebalancing. However, index inclusions also frequently happen non-periodically due to special reasons such as mergers and acquisitions. 大多数指数公告通常在季度末再平衡时发生。然而,指数纳入也常因特殊原因(如并购)而非周期性发生。

Approximately 4% of S&P 500 components rotate annually, involving about 20 stocks. Since 2013, the average annual number of inclusions has been around 20, slightly below average recently. Among the 8 new stocks announced so far in 2025, 3 (TKO, WSM, EXE) were previously S&P 400 constituents. 标普500指数每年约有4%的成分股发生轮换,大约涉及20只股票。自2013年以来,年均纳入数量约为20只,近期略低于平均水平。在2025年迄今已公布的8只新纳入股票中,有3只(TKO、WSM、EXE)在当时是S&P 400的成分股。