Prompt: Input Structuring - EN

Intelligent Content Structuring Tool

Input Structuring EN is a polished prompt designed for knowledge workers, aiming to extract, organize, and structure information from Markdown-formatted content, enabling better analysis and archiving within an Obsidian knowledge base. This tool transforms unstructured text into clear, hierarchical, structured knowledge through a systematic methodology.

Purpose & Value

Knowledge Extraction

Accurately extract core information, data, and insights from complex Markdown content.

Structured Organization

Systematically organize scattered information by theme, hierarchy, and importance.

Efficient Archiving

Optimize the storage and retrieval efficiency of information in an Obsidian vault.

Core Value Proposition

Reduce reading and organization time by 70%

Ensure 100% of important information is captured

A unified structure facilitates subsequent analysis and citation.

Automatically identify core arguments and key evidence.

Core Methodology

Four-Step Processing Method

Step 1: Read & Understand

Deeply read content from the perspective of a knowledge worker.

Step 2: Identify & Extract

Identify themes, arguments, data, and charts.

Step 3: Structure & Organize

Organize information by importance and logical relationships.

Step 4: Format & Output

Generate standardized Obsidian-formatted documents.

Intelligent Analysis Principles

- Distinguish core arguments from supporting rhetoric.

- Prioritize extraction of data, facts, and logic.

- Maintain the integrity of the original logical structure.

- Intelligently judge the importance level of information.

Processing Priority

Detailed Workflow

Extract Key Logic

First, summarize the author's core message and supporting arguments to form a complete logical overview.

Output Location: ### Key Logic section

Identify Themes and Details

Analyze different themes or aspects of the content, extracting specific details under each theme.

Theme Identification

Detail Extraction

Chart Association

Apply Format Specifications

Format the output content according to Obsidian syntax specifications.

Header Levels

Entity Links

Number Highlighting

Image Embedding

Generate Tag System

Generate at least 10 relevant tags based on the content, covering keywords, themes, entities, etc.

Output Format Specification

Standard Output Structure

### Key Logic

The core message of the author/source expressed in a complete, logical paragraph.

### Topic Sentence of the First Section

- Detail 1 of the first section

- Important detail 2 of the first section

- (Image Title in English)

- ![[image.jpg]]

> [!table] Table Title

> - Key findings from the table

> - Noteworthy data points

### Topic Sentence of the Second Section

- Detail of the second section

- Deeper level information

- Supporting data: $12.3 billion

- Related company: [[Apple]]

#tag1 #tag2 #tag3 ... (at least 10)Hierarchical Structure

- • Level 1 Header: ### + Topic Sentence

- • Level 2 Content: - Key point detail

- • Level 3 Content: Nested list

- • Important Content: **Bold**

Media Handling

- • Image: ![[full_path]]

- • Must include an English title

- • Keep original filename

- • Place near relevant content

Detailed Syntax Rules

Entity Linking Rules

[[Company Name]]

Basic Format: English entity name

[[Alphabet|Google]]

Alias Format: Formal Name|Common Name

[[Nvidia|英伟达]]

Alias with Local Name: English Name|Local Name

Number Highlighting Rules

==12.3== billion USD

Number + Unit: Highlight only the number

growth of ==15.5==%

Percentage: Highlight only the numerical value

[[S&P500]]

Entities containing numbers: Do not highlight

Table Handling Rules

> [!table] Table Title

> - Key finding 1

> - Key finding 2

Do not nest in lists, write at the top level.

Tag Generation Rules

• Generate at least 10 tags.

• Use English for all.

• Cover keywords/themes/entities.

• Place at the end of the document.

• Format: #tag_name

Common Mistake Reminders

❌ Incorrect Examples

- • **==123==** (Syntax nesting)

- • [[==Apple==]] (Highlighting entity names)

- • #[[keyword]] (Tag contains a link)

- • Nesting a callout in a list

✅ Correct Examples

- • **Important content** ==123== billion

- • [[Apple]]

- • #keyword

- • Top-level callout

Use Cases

Processing Research Reports

- Extracting core ideas from brokerage reports.

- Structuring industry analysis reports.

- Summarizing key points of in-depth company reports.

Organizing Financial Data

- Extracting and archiving key financial statement data.

- Structuring earnings call transcripts.

- Organizing comparative analysis of financial indicators.

Processing Meeting Minutes

- Distilling key points from investment meetings.

- Systematically organizing roadshow records.

- Structuring expert interview content.

Archiving News & Information

- Extracting key points from industry news.

- Organizing key information from policy documents.

- Structuring records of market dynamics.

Usage Statistics

Usage Example (Live Example)

This is a real-world use case demonstrating how to convert an original Goldman Sachs research report into a structured Obsidian note using this tool.

Click to View Original PromptOriginal Input

# GOAL Kickstart - Dovish and De-escalation - Markets embrace a Goldilocks Backdrop

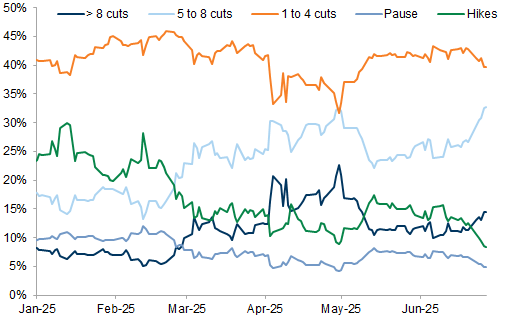

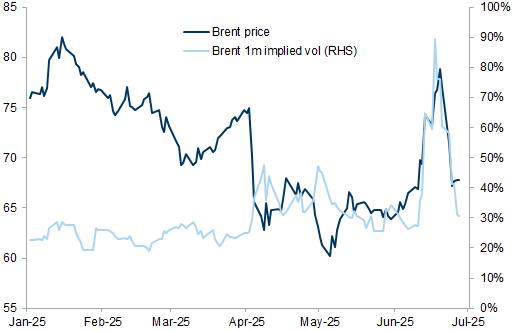

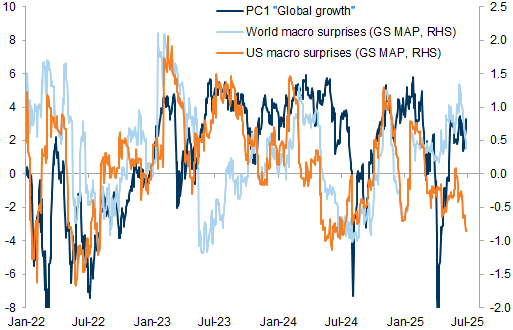

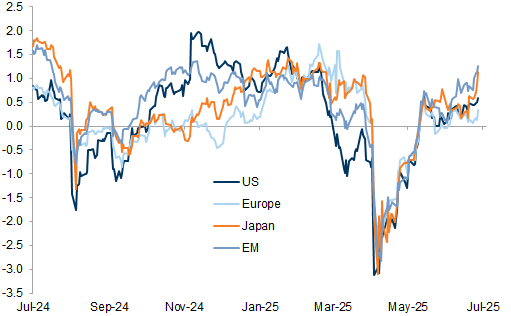

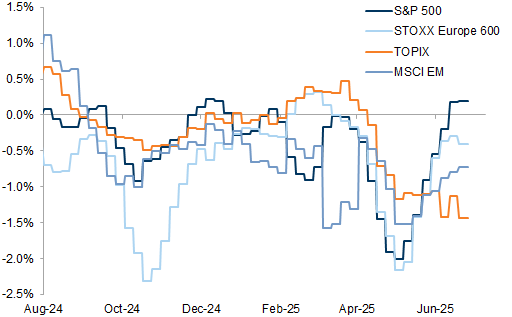

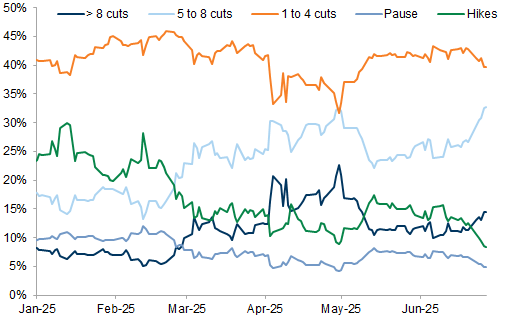

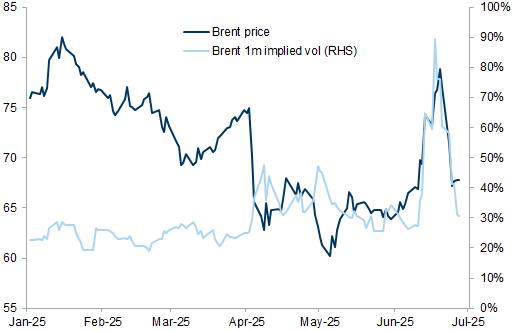

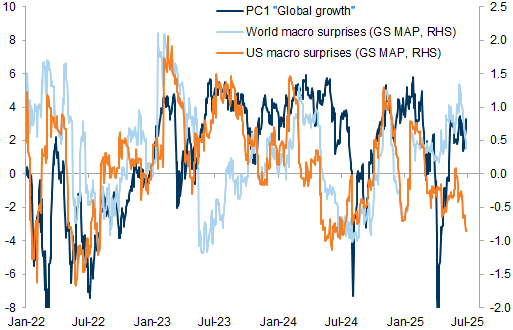

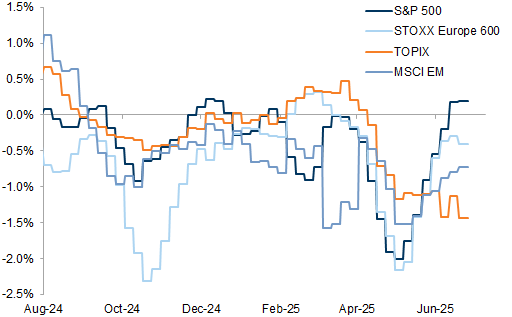

Last week increased expectations of a more dovish Fed ([Exhibit 1](...)), de-escalation of Middle East tensions ([Exhibit 2](...)) and progress in U.S. trade negotiations (including removal of section 899) supported growth pricing across assets. [Our Economists pulled forward their forecast for the next cut to September](...) and reduced their terminal rate forecast to 3-3.25%. Indeed, our PC1 "Global growth" factor improved last week despite deteriorating macro surprises, especially in the US with [Personal spending](...), [New home sales](...), and [Consumer confidence](...) below consensus last week ([Exhibit 3](...)). With greater expectation of a more dovish Fed, this created a "Goldilocks" regime and supported risky assets and a large re-set in cross-asset implied vol, which boosted risk appetite (our [Risk Appetite Indicator](...) rebounded to 0.3, [Exhibit 10](...)) and US equities to a new all-time high. This Thursday's labour market data could be critical to sustain the positive momentum - [our economists expect 85k for non-farm payrolls, below consensus of +113k](...). The bullish growth repricing was broad geographically, with equities outperforming bonds and cyclicals outperforming defensives across regions ([Exhibit 4](...)). On the other hand, [the rally in USD HY has been led by defensive sectors](...) and there has been more regional dispersion in inflation pricing.

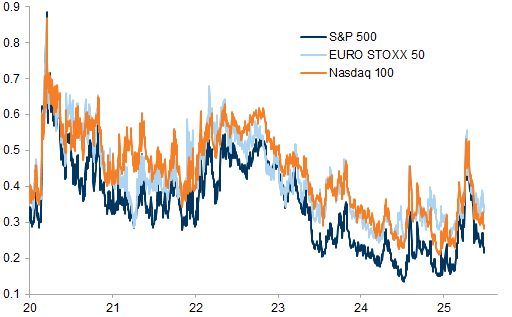

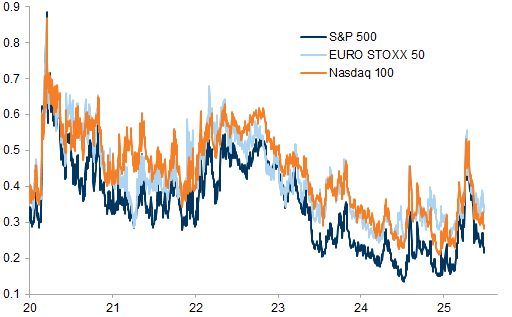

Expectations for equity fundamentals have been under less pressure recently. Consensus EPS revisions have turned less negative in most regions over the past month, and have turned positive for the US market ([Exhibit 5](...)). The Q2 earnings season will be a key focus for investors - our [US strategists note a relatively low bar to beat (consensus expects 4% EPS growth in 2Q, down from 12% in 1Q) but expect important insights on how companies are adjusting to increased tariff rates](...). Implied equity correlations have been falling since April across markets, reflecting investor expectations of more dispersion into the earnings season and fading macro risk - the S&P 500 and Nasdaq 100 implied correlations are now at the 17th/10th percentile since 2020 respectively - this is much in contrast to EURO STOXX 50 ([Exhibit 6](...)). Reverse dispersion trades appear attractive as a macro hedge against a larger growth backdrop deterioration over the summer.

Our asset allocation remains neutral but focused on [diversification both across regions and styles](...) into the summer. We also [continue to recommend option hedges](...): with markets pricing a more "Goldilocks" backdrop, we think USD HY puts/CDS payers looks attractive to hedge a stagflationary shock, while rates payers look attractive to hedge a more reflationary rebound. We also highlight calls/risk-reversals on Euro Area Banks (SX7E) and collars on MSCI EM to hedge a reversal in positioning.

# Dovish and De-escalation - Markets embrace a Goldilocks Backdrop

#### Exhibit 1: Markets are pricing more dovish Fed

Option-implied probability of Fed rates over the next 12 months

[](...)

#### Exhibit 2: Markets have priced lower geopolitical risk

[](...)

#### Exhibit 3: Last week, markets priced higher growth expectations despite worsening macro surprises

[](...)

#### Exhibit 4: Growth repricing was broad across regions

Average 1y z-score of equity vs. bonds, cyclical vs. defensives, credit spreads, 10y inflation swap

[](...)

#### Exhibit 5: Earnings revisions have improved across most regions and turned positive in the US

1-month FY2 EPS revision

[](...)

#### Exhibit 6: Implied correlation has come down since April

3m 50-delta implied correlation

[](...)

Structured Output

Key Logic

Goldman Sachs analysts believe that last week, under the combined effect of a more dovish Fed, de-escalating Middle East tensions, and progress in U.S. trade negotiations, the market presented a "Goldilocks Backdrop". This means that despite deteriorating macroeconomic data, the market maintained positive pricing for growth, which drove the rally in Risk Assets and pushed US equities to new highs. Meanwhile, Goldman Sachs advises that against this backdrop, investors should focus on Diversification and adopt Option Hedges strategies.

Formation and Drivers of the Market's "Goldilocks Backdrop"

- Last week's market performance as a "Goldilocks Backdrop" was mainly supported by the following three factors:

- Strengthened Dovish Fed Expectations:

- Goldman Sachs economists have brought forward their forecast for the first rate cut to September and lowered their Terminal Rate forecast to 3%-3.25%.

- Market pricing indicates that the Option-implied probability for Fed rates over the next 12 months leans dovish.

- The market's expectation of a more dovish Fed created this "Goldilocks Backdrop," supporting risk assets.

Markets are pricing a more dovish Fed

- Easing Middle East Tensions: The market has priced in lower Geopolitical Risk.

Markets have priced lower geopolitical risk

- Progress in U.S. Trade Negotiations: Including the removal of the Section 899 clause.

- Strengthened Dovish Fed Expectations:

- Despite weak macro data, the market continues to price in high growth:

- Goldman Sachs' PC1 "Global growth" factor improved last week, even as Macro Surprises deteriorated, especially in the US.

- US macro data below consensus: Including Personal Spending, New Home Sales, and Consumer Confidence.

Last week, markets priced higher growth expectations despite worsening macro surprises

Changes in Corporate Earnings Expectations and Market Correlation

- Pressure on Equity Fundamentals expectations has recently eased.

- Consensus EPS Revisions have become less negative in most regions over the past month and have turned Positive in the US market.

Earnings revisions have improved across most regions and turned positive in the US

- Implied Equity Correlations have been declining since April:

- The implied correlations for the S&P 500 and Nasdaq 100 are now at the 17th and 10th percentiles since 2020, respectively.

Implied correlation has come down since April

- Reverse Dispersion Trades appear attractive as a macro hedge against a deterioration of the Growth backdrop over the Summer.

Goldman Sachs' Asset Allocation Recommendations and Hedging Strategies

- The strategic focus is on diversification across regions and styles.

- Continued recommendation of Option Hedges:

- To hedge against a Stagflationary Shock: USD HY Puts/CDS Payers.

- To hedge against a Reflationary Rebound: Rates Payers.

- Others: Calls/Risk-Reversals on Euro Area Banks (SX7E), and Collars on MSCI EM.

Design Philosophy

Core Design Principles

Precision

Accurately identify and extract core information, avoiding redundancy.

Structure

Clear hierarchical relationships and logical organization.

Reusability

Standardized format facilitates subsequent citation and analysis.

Intelligent Features

Contextual Understanding

Judge information importance based on content context.

Adaptive Extraction

Adjust processing strategies based on content type.

Relational Analysis

Automatically identify logical relationships between pieces of information.

User Value

Save Time

Automated processing reduces manual organization work.

Improve Quality

Standardized output ensures information integrity.

Enhance Collaboration

Unified format facilitates team knowledge sharing.

Future Optimization Directions

Multi-language Support

Expand content processing to more languages.

Enhanced Intelligent Analysis

Optimize information extraction algorithms with deep learning.

Integration & Expansion

Seamless integration with more tools and platforms.

Input Structuring EN - Intelligent Content Structuring Tool

Designed for Investment Analysts | Powered by AI