Input Structuring CN

智能内容结构化处理工具

Input Structuring CN 是一个专门为知识工作者设计的智能prompt,旨在从Markdown格式的内容中提取、组织和结构化信息,使其能够更好地在Obsidian知识库中进行分析和归档。这个工具通过系统化的方法论,将非结构化的文本内容转化为清晰、有层次的结构化知识。

目的与价值

知识提取

从复杂的Markdown内容中精准提取核心信息、数据和洞察

结构化组织

将散乱信息按主题、层级和重要性进行系统化整理

高效归档

优化信息在Obsidian vault中的存储和检索效率

核心价值主张

将阅读和整理时间减少 70%

确保 100% 重要信息被捕获

统一的结构便于后续分析和引用

自动识别核心论点和关键证据

核心方法论

四步处理法

阅读理解

以知识工作者视角深度阅读内容

识别提取

识别主题、论点、数据和图表

结构组织

按重要性和逻辑关系组织信息

格式输出

生成标准化的Obsidian格式文档

智能分析原则

- 区分核心论点与辅助修辞

- 优先提取数据、事实和逻辑

- 保持原文逻辑结构的完整性

- 智能判断信息的重要性层级

处理优先级

详细工作流程

提取核心逻辑

首先总结作者的核心信息和支撑论点,形成一段完整的逻辑概述

输出位置:### Key Logic 部分

识别主题和细节

分析内容的不同主题或方面,提取每个主题下的具体细节

主题识别

细节提取

图表关联

应用格式规范

按照Obsidian语法规范格式化输出内容

标题层级

实体链接

数字高亮

图片嵌入

生成标签系统

根据内容生成至少10个相关标签,涵盖关键词、主题、实体等

输出格式规范

标准输出结构

### Key Logic

作者/信息源的核心信息用一段完整逻辑表达

### 第一个部分的主旨句

- 第一部分的细节1

- 第一部分的重要细节2

- (中文图片标题)

- ![[image.jpg]]

> [!table] 表格标题

> - 表格的关键发现

> - 值得注意的数据点

### 第二个部分的主旨句

- 第二部分的细节

- 更深层的信息

- 支撑数据:123亿美元

- 相关公司:[[Apple|苹果]]

#tag1 #tag2 #tag3 ... (至少10个)层级结构

- • 一级标题:### + 主题句

- • 二级内容:- 要点细节

- • 三级内容:嵌套列表

- • 重要内容:**加粗**

媒体处理

- • 图片:![[完整路径]]

- • 必须包含中文标题

- • 保持原始文件名

- • 放置在相关内容处

语法规则详解

实体链接规则

[[Company Name]]

基础格式:英文实体名

[[Alphabet|Google]]

别名格式:正式名|常用名

[[Nvidia|英伟达]]

中文别名:英文名|中文名

数字高亮规则

==123==亿美元

数字+单位:仅高亮数字

增长==15.5==%

百分比:仅高亮数值

[[S&P500]]

含数字的实体:不高亮

表格处理规则

> [!table] 表格标题

> - 关键发现1

> - 关键发现2

不嵌套在列表中,顶格书写

标签生成规则

• 最少生成10个标签

• 全部使用英文

• 涵盖关键词/主题/实体

• 放置在文档末尾

• 格式:#tag_name

常见错误提醒

❌ 错误示例

- • **==123==** (语法嵌套)

- • [[==Apple==]] (高亮实体名)

- • #[[keyword]] (标签含链接)

- • 嵌套callout在列表中

✅ 正确示例

- • **重要内容** ==123==亿

- • [[Apple|苹果]]

- • #keyword

- • 顶格书写callout

应用场景

研究报告处理

- 券商研报的核心观点提取

- 行业分析报告的结构化

- 公司深度报告的要点整理

财务数据整理

- 财报关键数据的提取归档

- 业绩说明会纪要的结构化

- 财务指标对比分析整理

会议纪要处理

- 投资会议要点的提炼

- 路演记录的系统整理

- 专家访谈内容的结构化

新闻资讯归档

- 行业新闻的要点提取

- 政策文件的关键信息整理

- 市场动态的结构化记录

使用效果统计

使用示例 (Live Example)

这是一个真实使用场景,展示了如何将一份高盛的研究报告原文,通过本工具转化为结构化的Obsidian笔记。

点击查看 Prompt 原文原始输入 (Original Input)

# GOAL Kickstart - Dovish and De-escalation - Markets embrace a Goldilocks Backdrop

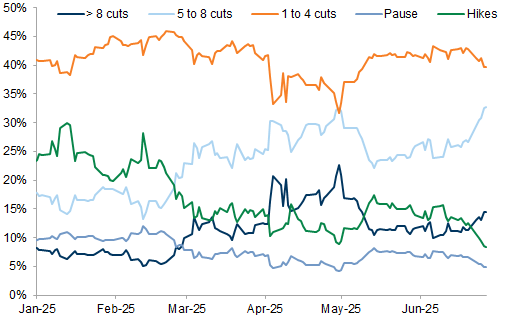

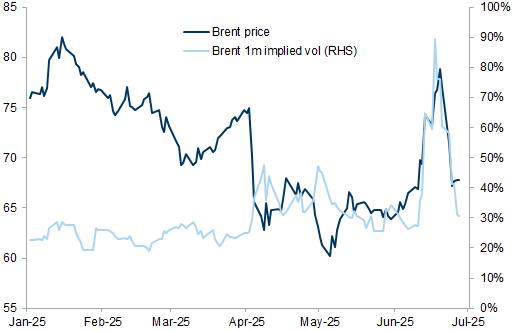

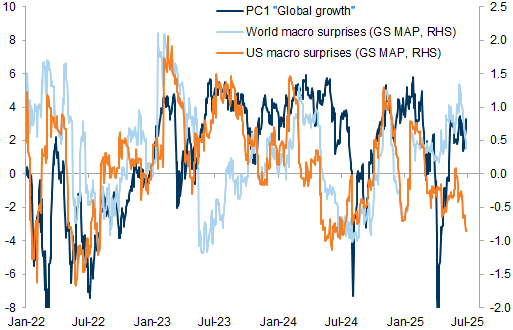

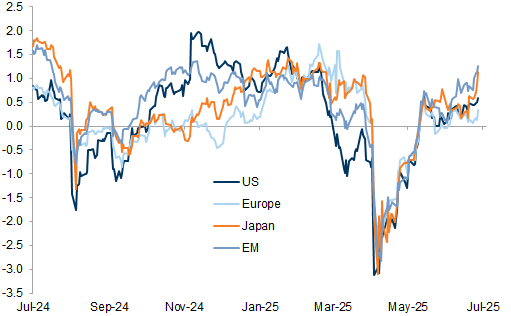

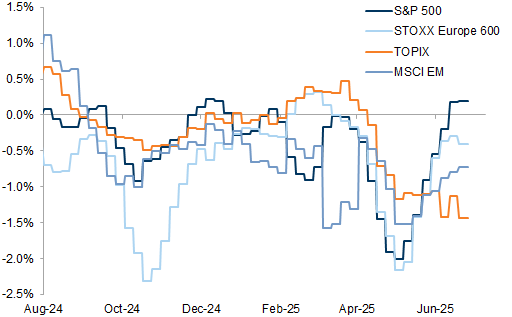

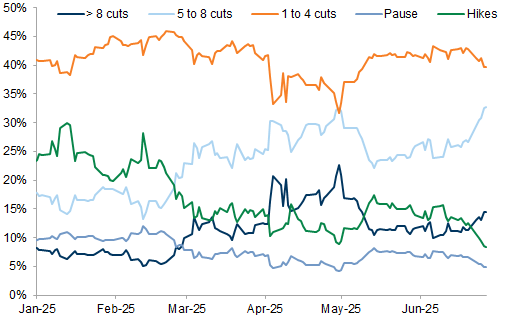

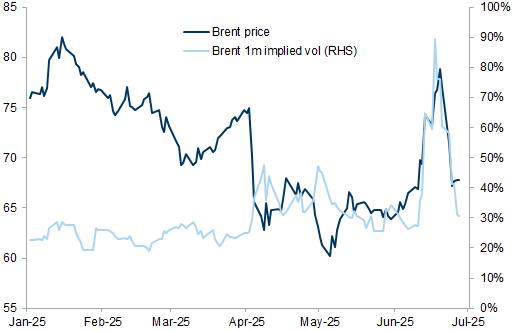

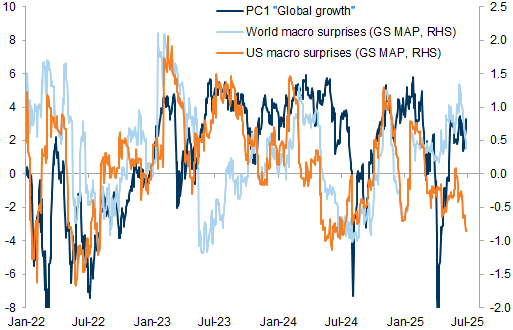

Last week increased expectations of a more dovish Fed ([Exhibit 1](...)), de-escalation of Middle East tensions ([Exhibit 2](...)) and progress in U.S. trade negotiations (including removal of section 899) supported growth pricing across assets. [Our Economists pulled forward their forecast for the next cut to September](...) and reduced their terminal rate forecast to 3-3.25%. Indeed, our PC1 "Global growth" factor improved last week despite deteriorating macro surprises, especially in the US with [Personal spending](...), [New home sales](...), and [Consumer confidence](...) below consensus last week ([Exhibit 3](...)). With greater expectation of a more dovish Fed, this created a "Goldilocks" regime and supported risky assets and a large re-set in cross-asset implied vol, which boosted risk appetite (our [Risk Appetite Indicator](...) rebounded to 0.3, [Exhibit 10](...)) and US equities to a new all-time high. This Thursday's labour market data could be critical to sustain the positive momentum - [our economists expect 85k for non-farm payrolls, below consensus of +113k](...). The bullish growth repricing was broad geographically, with equities outperforming bonds and cyclicals outperforming defensives across regions ([Exhibit 4](...)). On the other hand, [the rally in USD HY has been led by defensive sectors](...) and there has been more regional dispersion in inflation pricing.

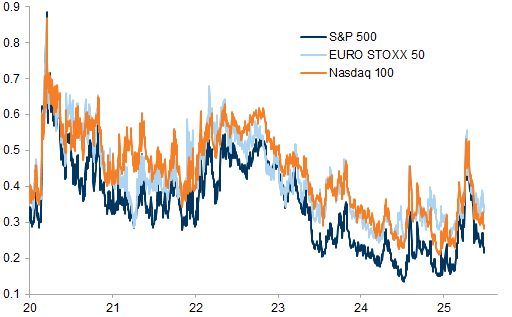

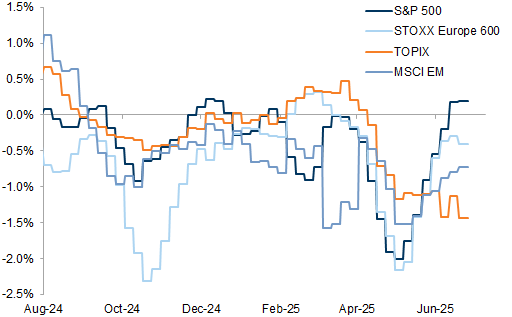

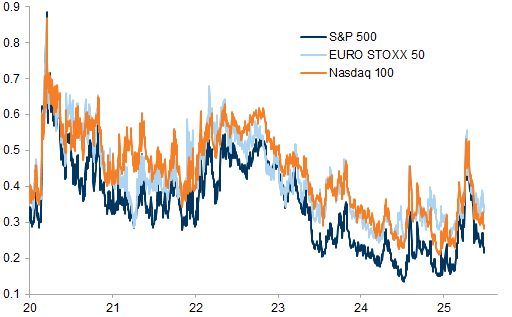

Expectations for equity fundamentals have been under less pressure recently. Consensus EPS revisions have turned less negative in most regions over the past month, and have turned positive for the US market ([Exhibit 5](...)). The Q2 earnings season will be a key focus for investors - our [US strategists note a relatively low bar to beat (consensus expects 4% EPS growth in 2Q, down from 12% in 1Q) but expect important insights on how companies are adjusting to increased tariff rates](...). Implied equity correlations have been falling since April across markets, reflecting investor expectations of more dispersion into the earnings season and fading macro risk - the S&P 500 and Nasdaq 100 implied correlations are now at the 17th/10th percentile since 2020 respectively - this is much in contrast to EURO STOXX 50 ([Exhibit 6](...)). Reverse dispersion trades appear attractive as a macro hedge against a larger growth backdrop deterioration over the summer.

Our asset allocation remains neutral but focused on [diversification both across regions and styles](...) into the summer. We also [continue to recommend option hedges](...): with markets pricing a more "Goldilocks" backdrop, we think USD HY puts/CDS payers looks attractive to hedge a stagflationary shock, while rates payers look attractive to hedge a more reflationary rebound. We also highlight calls/risk-reversals on Euro Area Banks (SX7E) and collars on MSCI EM to hedge a reversal in positioning.

# Dovish and De-escalation - Markets embrace a Goldilocks Backdrop

#### Exhibit 1: Markets are pricing more dovish Fed

Option-implied probability of Fed rates over the next 12 months

[](...)

#### Exhibit 2: Markets have priced lower geopolitical risk

[](...)

#### Exhibit 3: Last week, markets priced higher growth expectations despite worsening macro surprises

[](...)

#### Exhibit 4: Growth repricing was broad across regions

Average 1y z-score of equity vs. bonds, cyclical vs. defensives, credit spreads, 10y inflation swap

[](...)

#### Exhibit 5: Earnings revisions have improved across most regions and turned positive in the US

1-month FY2 EPS revision

[](...)

#### Exhibit 6: Implied correlation has come down since April

3m 50-delta implied correlation

[](...)

结构化输出 (Structured Output)

Key Logic

高盛(Goldman Sachs)分析师认为,上周市场在美联储(Fed)转向鸽派、中东局势(Middle East tensions)降温以及美国贸易谈判(U.S. trade negotiations)取得进展的共同作用下,呈现出一种“金发女孩情景”(Goldilocks Backdrop),即尽管宏观经济数据出现恶化,但市场仍对增长抱有积极定价,这推动了风险资产(Risk Assets)的上涨和美国股市(US equities)创下新高,同时高盛建议在此背景下,投资者应关注分散化(Diversification)并采取期权对冲(Option Hedges)策略。

市场“金发女孩情景”的形成与驱动因素

- 上周市场表现为“金发女孩情景”,主要受到以下三个因素的支撑:

- 美联储(Fed)鸽派预期增强:

- 高盛经济学家已将首次降息预测提前至September,并将终端利率(Terminal Rate)预测下调至3%-3.25%。

- 市场定价显示,对于未来12个月美联储利率的期权隐含概率(Option-implied probability)倾向于鸽派。

- 市场对美联储更为鸽派的预期,创造了这种“金发女孩情景”,支撑了风险资产。

市场正在定价更为鸽派的美联储

- 中东局势(Middle East Tensions)缓和:市场已将地缘政治风险(Geopolitical Risk)定价得更低。

市场已将更低的地缘政治风险定价

- 美国贸易谈判(U.S. Trade Negotiations)取得进展:包括取消Section 899条款。

- 美联储(Fed)鸽派预期增强:

- 尽管宏观数据表现不佳,市场仍定价高增长:

- 高盛(Goldman Sachs)的PC1 “全球增长”因子(PC1 "Global growth" factor)上周有所改善,即便宏观意外数据(Macro Surprises)恶化,尤其是在美国。

- 美国宏观数据低于共识预期:包括个人消费支出(Personal Spending)、新屋销售(New Home Sales)和消费者信心(Consumer Confidence)。

上周市场定价更高的增长预期,尽管宏观意外恶化

企业盈利预期与市场相关性的变化

- 股票基本面(Equity Fundamentals)预期压力近期有所减轻。

- 共识EPS修正(Consensus EPS Revisions)在过去一个月内,在大多数区域变得不那么负面,而在美国市场(US market)转为正向(Positive)。

盈利修正在大多数区域有所改善,并在美国转为正向

- 隐含股票相关性(Implied Equity Correlations)自April以来持续下降:

- S&P 500和Nasdaq 100的隐含相关性(Implied Correlations)目前分别处于自2020年以来的第17和第10个百分位。

隐含相关性自April以来有所下降

- 反向分散交易(Reverse Dispersion Trades)作为对冲夏季(Summer)经济增长(Growth)背景恶化的宏观对冲工具显得有吸引力。

高盛的资产配置建议与对冲策略

- 策略重点是区域(Region)和风格(Style)的分散化(Diversification)。

- 持续推荐期权对冲(Option Hedges):

- 对冲滞胀冲击(Stagflationary Shock):美元高收益债(USD HY)看跌期权(Puts)/信用违约互换支付方(CDS Payers)。

- 对冲再通胀反弹(Reflationary Rebound):利率支付方(Rates Payers)。

- 其他:欧元区银行(Euro Area Banks, SX7E)的看涨期权(Calls)/风险逆转(Risk-Reversals),以及MSCI EM的领口策略(Collars)。

设计理念

核心设计原则

精准性

准确识别和提取核心信息,避免冗余

结构化

清晰的层级关系和逻辑组织

可复用

标准化格式便于后续引用和分析

智能化特性

上下文理解

基于内容语境判断信息重要性

自适应提取

根据内容类型调整处理策略

关联性分析

自动识别信息间的逻辑关系

用户价值

节省时间

自动化处理减少手动整理工作

提升质量

标准化输出保证信息完整性

增强协作

统一格式便于团队知识共享

持续优化方向

多语言支持

扩展到更多语言的内容处理

智能分析增强

深度学习优化信息提取算法

集成扩展

与更多工具和平台无缝对接

Input Structuring CN - 智能内容结构化工具

Designed for Investment Analysts | Powered by AI