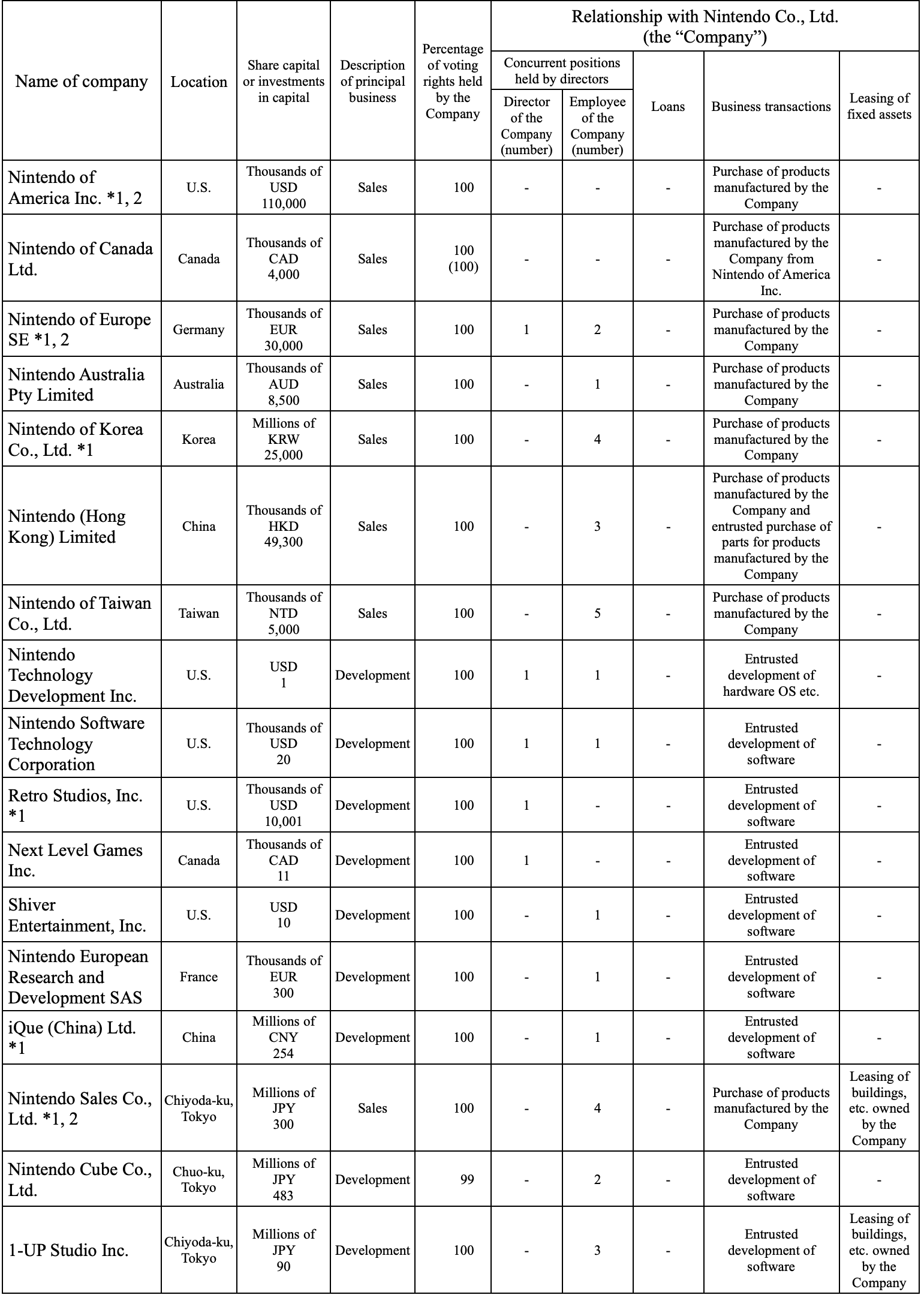

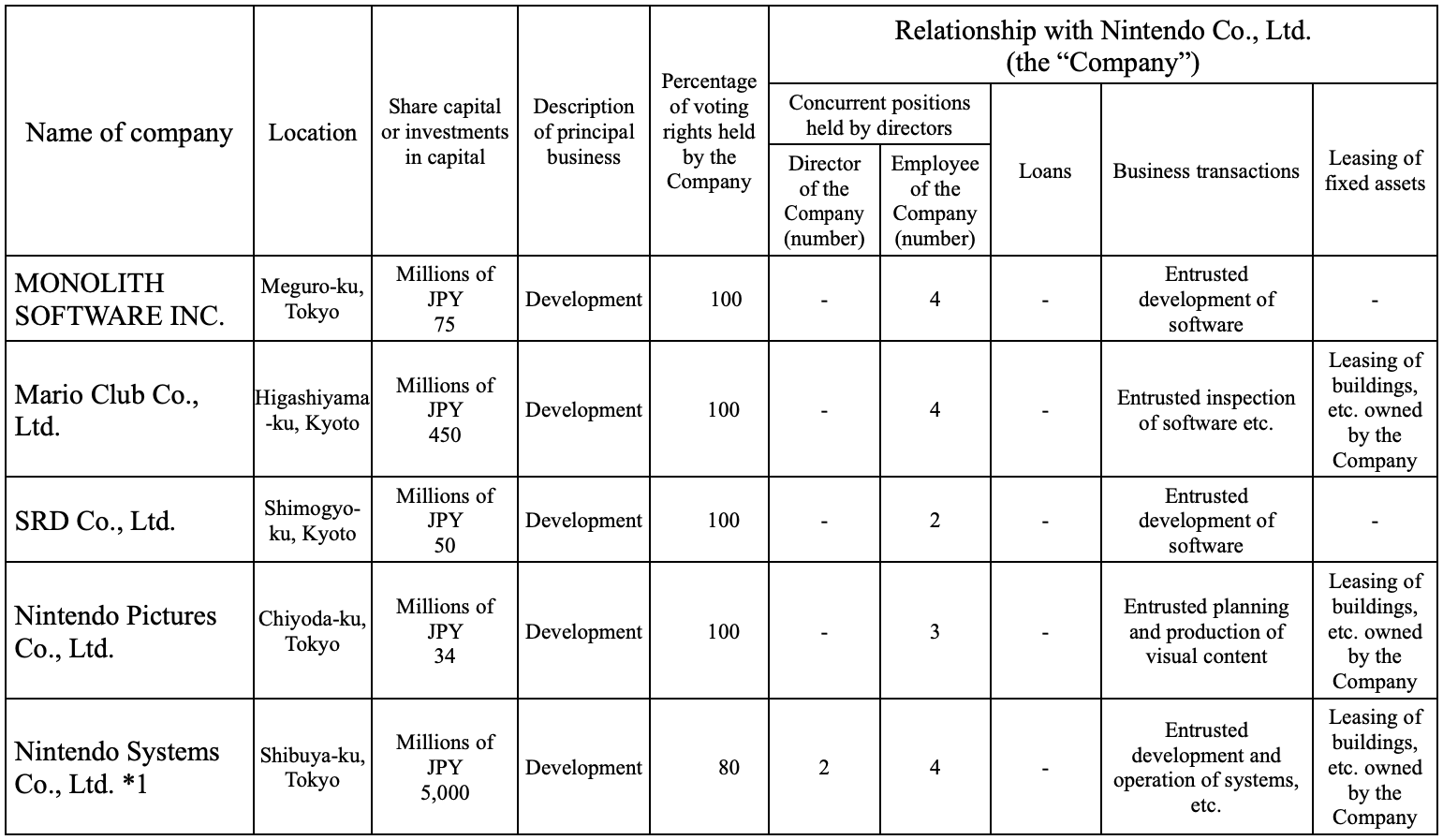

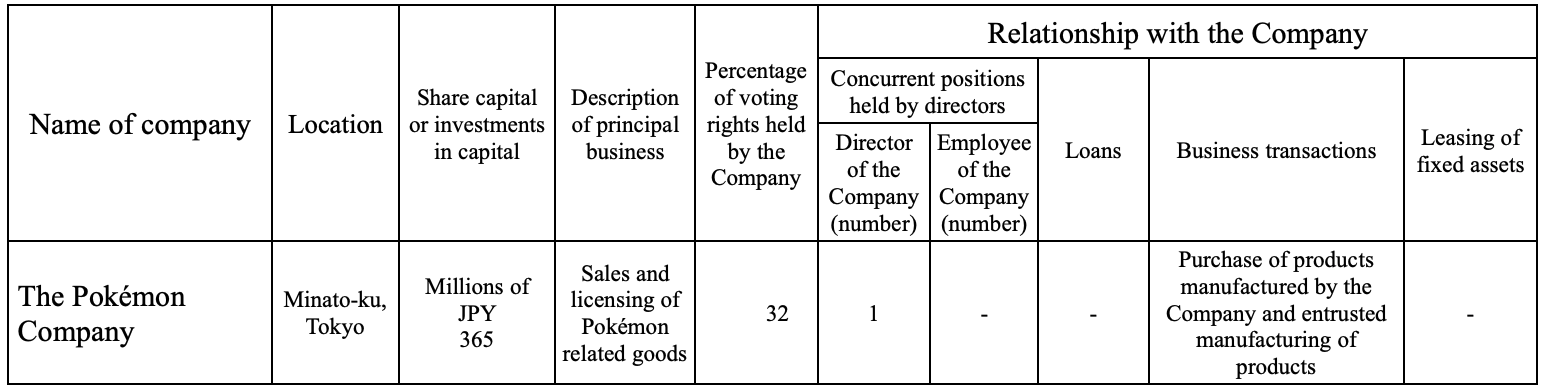

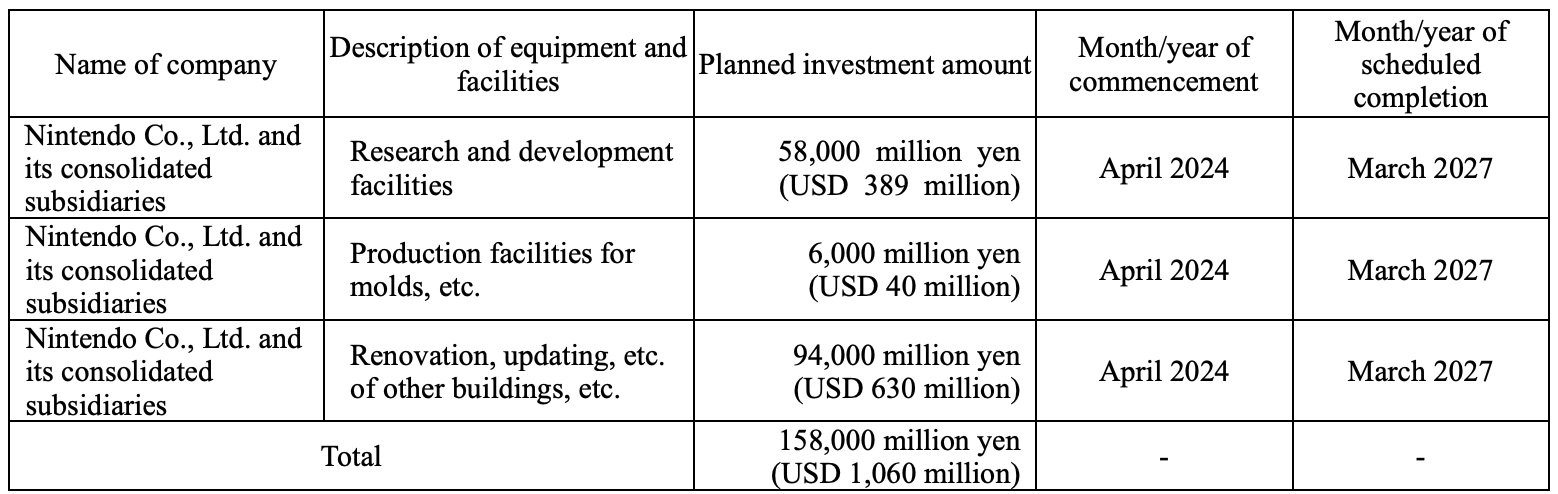

Main Facilities

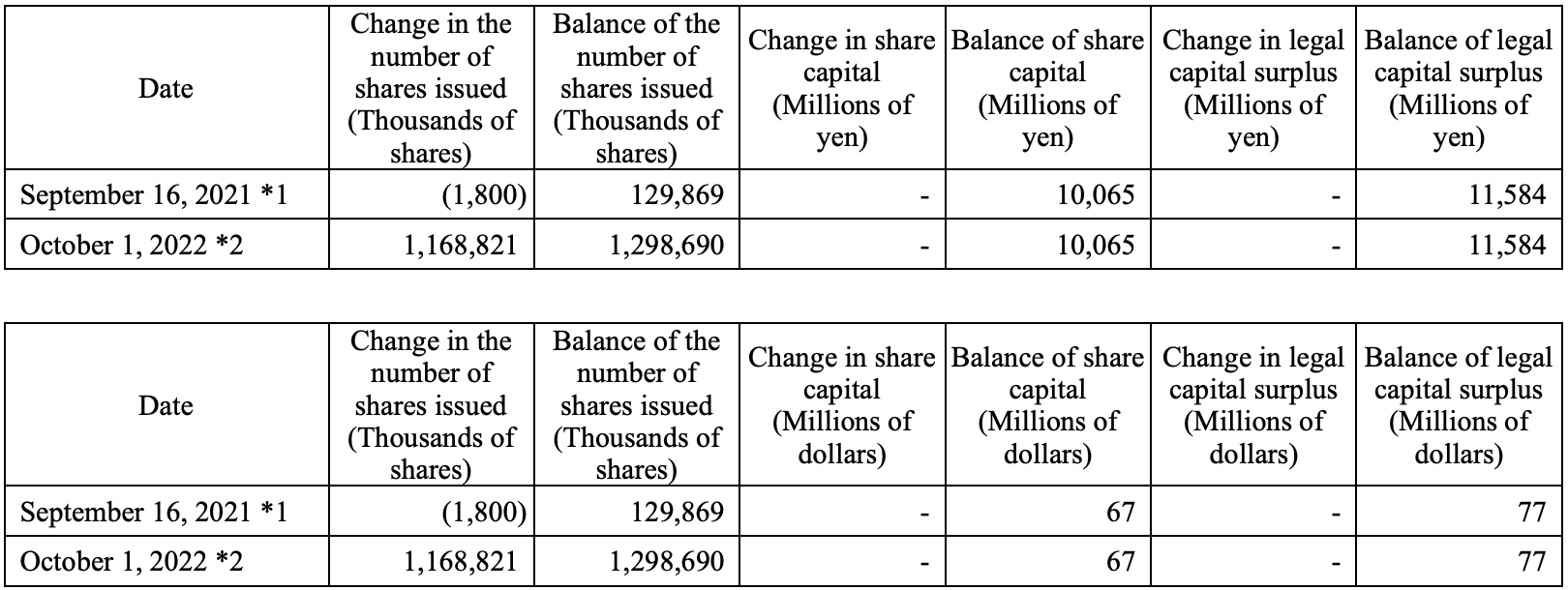

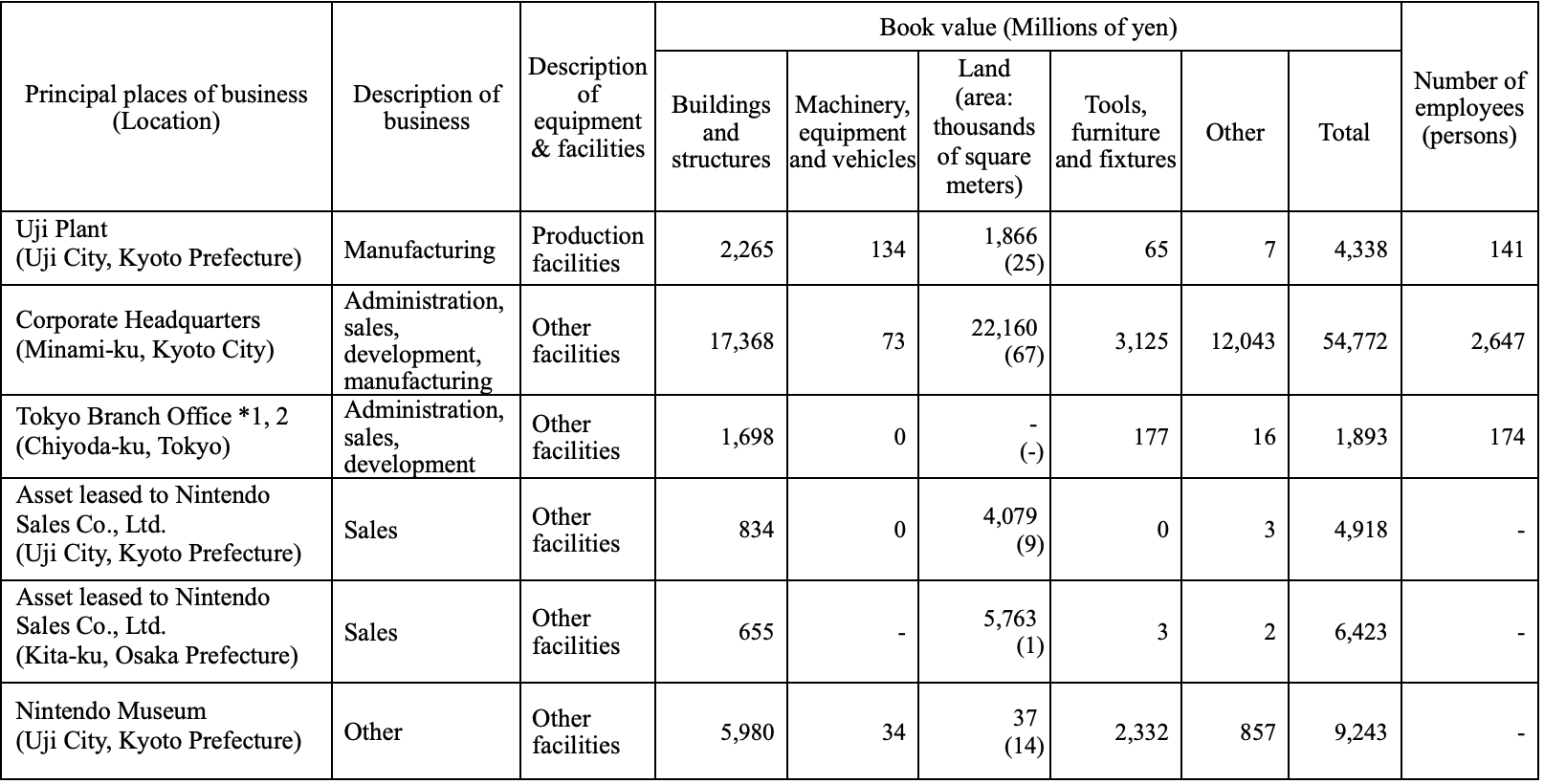

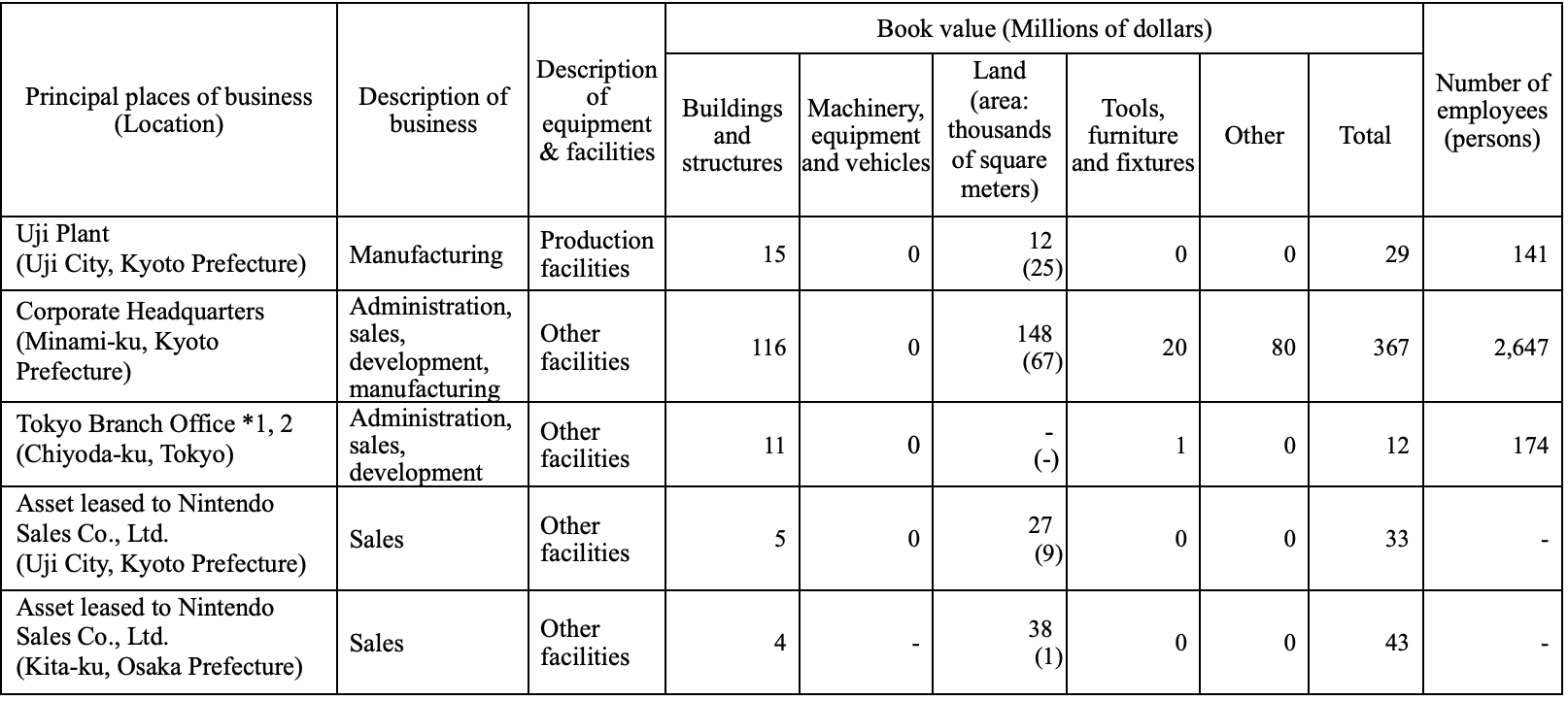

Major Facilities Book Value & Employees (Nintendo Co., Ltd.)

- Corporate Headquarters (Kyoto): Highest book value (¥54,772 million JPY / USD 367 million), most employees (2,647), involves management, sales, development and manufacturing.

- Uji Plant (Kyoto): Main production facility, book value ¥4,338 million JPY (USD 29 million), 141 employees.

- Nintendo Museum (Kyoto): Book value ¥9,243 million JPY (USD 62 million), listed as "other facilities".

- Tokyo Branch Office: Rented office, annual rent ¥1,486 million JPY (USD 9 million).

Main Facilities (JPY, Raw Data)

Main Facilities (USD, Raw Data)

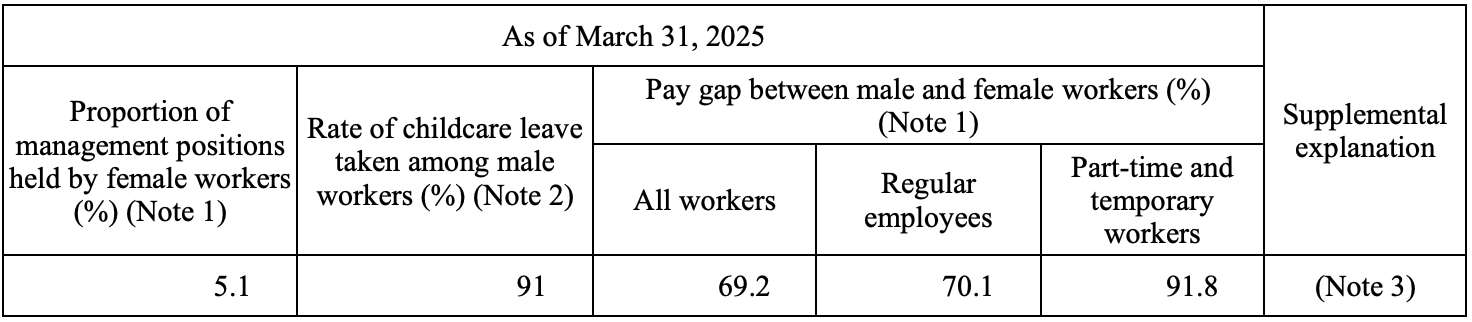

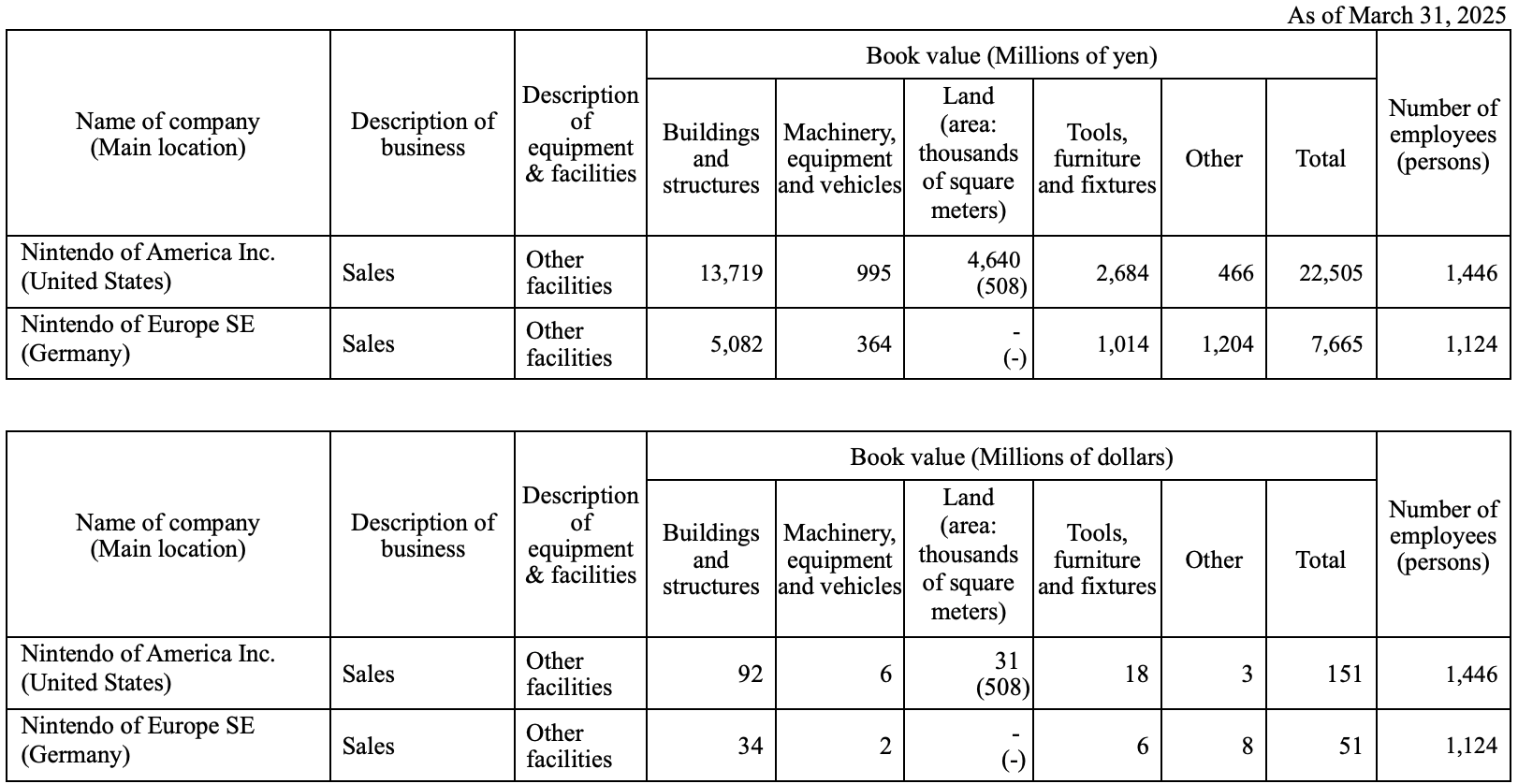

Overseas Subsidiary Main Facilities (Book Value)

- Nintendo of America Inc. (US): Total book value ¥22,505 million JPY (USD 151 million), highest among overseas subsidiaries.

- Nintendo of Europe SE (Germany): Total book value ¥7,665 million JPY (USD 51 million).

- Significant investment in facilities by two major overseas sales subsidiaries.

Overseas Subsidiaries Main Facilities (Raw Data Image)